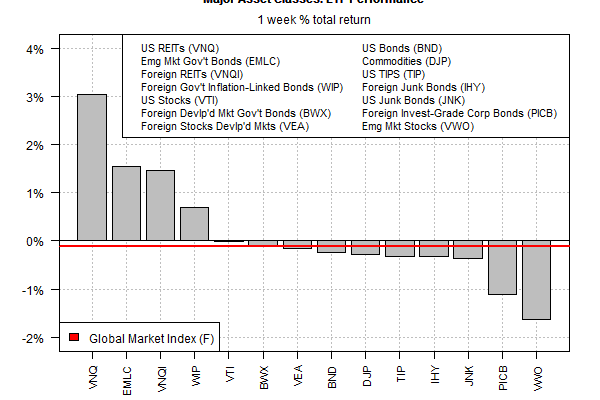

Real estate investment trusts (REITs) in the US posted the biggest gain by far for the major asset classes last week, based on a set of exchange-traded products. By contrast, last week’s biggest loser: equities in emerging markets.

Vanguard Real Estate (VNQ) topped the winner’s list over the five trading days through Friday, Oct. 19, with a 3.0% gain. The increase marks the first weekly advance for the ETF in more than a month.

Turning to the red ink brigade, Vanguard FTSE Emerging Markets (VWO) continued to fall, slumping 1.6%–the biggest setback among the major asset classes last week. The slide marks the fourth straight weekly loss for VWO, which closed near its lowest price in a year-and-a-half on Friday.

Investors are hoping that the strong rebound in China’s stock market today signals that emerging markets generally will find a degree of stability this week. The Shanghai Composite rallied for a second day on Monday, supported by bullish comments from several Chinese leaders and regulators.

Meanwhile, an ETF-based version of the Global Markets Index (GMI.F) ticked lower again last week. This investable, unmanaged benchmark that holds all the major asset classes in market-value weights fell for a fourth week, edging down 0.1%.

For one-year return, US equities continue to dominate. Despite recent weakness, Vanguard Total Stock Market (VTI) is up 9.3% on a total-return basis, the strongest year-over-year gain for the major asset classes by far.

Indeed, the rest of the field is mostly underwater for the trailing one-year change. The biggest setback as of last week’s close is found in emerging markets stocks: VWO has lost 12.5% over the past year.

GMI.F is still clinging to a slight year-over-year gain: the benchmark up 1.5% on a total-return basis for the trailing one-year performance through Friday.

For current drawdown, broadly defined commodities continue to post the biggest slide from the previous peak. The iPath Bloomberg Commodity (DJP) is nursing a 47% peak-to-trough decline. On the flip side, US junk bonds are posting the smallest drawdown – roughly 2%, based on SPDR Bloomberg Barclays High Yield Bond (JNK).