Crude oil inventories in the US rose last week as imports surged in the week ended November 15, the Energy Information Administration (EIA) said. US’ crude inventories rose by 500,000 barrels last week to stand at 430.3 million barrels, according to EIA’s weekly inventory report. Analysts had expected a much bigger build in the stockpiles last week.Stockpiles in the US were 4% below the five-year average for the time of the year. The build in crude oil stocks last week was significantly lower than the preceding week.In the week ended November 8, inventories had surged by 2.1 million barrels. This indicated a slowdown in the accumulation of stocks in the country as local demand picked up last week. At the time of writing, the price of West Texas Intermediate crude oil was $69.25 per barrel, up 0.7%. Refineries in the US operated at 90.2% of their operable capacity last week, compared with 91.4% in the preceding week, the agency said. The rise in stockpiles had weighed on oil prices initially, but rising geopolitical tensions have helped reverse the losses on Thursday.

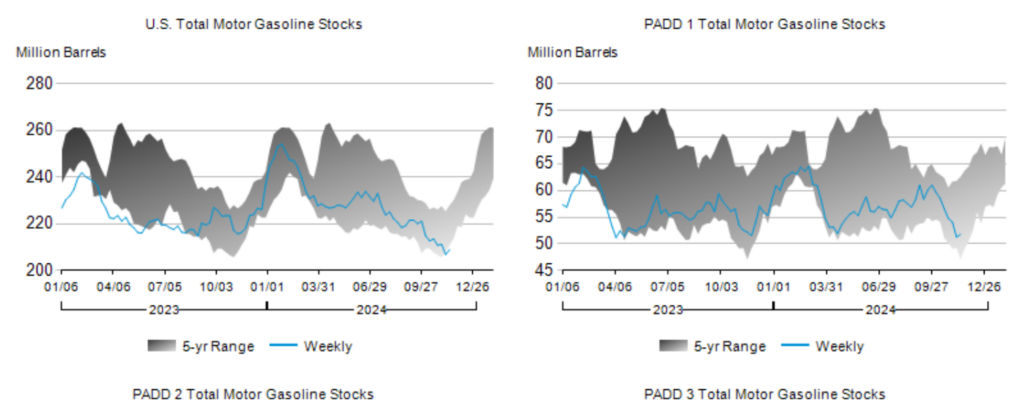

Gasoline stocks rise, distillate fallsGasoline stocks in the US rose 2.1 million barrels last week to 208.9 million barrels, according to the report. Gasoline inventories were about 4% below the five-year average for the time of the year. Meanwhile, distillate stocks fell slightly by just 100,000 barrels in the week ended November 15.Inventories stood at 114.3 million barrels, and were also 4% below the five-year average, EIA said.  Source: Stocks of fuel ethanol increased 500,000 barrels to 22.6 million barrels, while those of residual fuel rose 100,000 barrels to 23.8 million barrels. Meanwhile, stocks of propane and propylene declined 700,000 barrels to 97.7 million barrels last week.“The level of crude oil inventories is a crucial factor that influences the price of petroleum products. If the increase in crude inventories is more than expected, it implies weaker demand and is bearish for crude prices,” Investing.com said in a report. “In this case, the smaller than expected increase in crude oil inventories could be seen as a bullish signal for the oil market.”

Source: Stocks of fuel ethanol increased 500,000 barrels to 22.6 million barrels, while those of residual fuel rose 100,000 barrels to 23.8 million barrels. Meanwhile, stocks of propane and propylene declined 700,000 barrels to 97.7 million barrels last week.“The level of crude oil inventories is a crucial factor that influences the price of petroleum products. If the increase in crude inventories is more than expected, it implies weaker demand and is bearish for crude prices,” Investing.com said in a report. “In this case, the smaller than expected increase in crude oil inventories could be seen as a bullish signal for the oil market.”

Production fallsOil output in the world’s top producer fell last week by 199,000 barrels per day to 13.201 million barrels per day. Production in Alaska rose just 9,000 barrels per day to 441 million barrels per day. However, production slipped by 240,000 barrels per day in the Lower 48 US states to 12.760 million barrels per day, the EIA said. Oil production in the US though remained near record levels. EIA had earlier projected that average annual production is expected to be at record levels this year at 13.23 million barrels per day.This was about 300,000 barrels per day higher than 2023’s average level. For 2025, oil production was pegged even higher at 13.53 million barrels per day, according to the EIA’s Short Term Energy Outlook report.

Imports and exports surgeCrude oil imports by the US surged by 1.18 million barrels per day last week to stand at 7.68 million barrels per day. The four-week average imports rose 2.7% on a year-on-year basis to 6.60 million barrels per day last week, according to the report. In the week ended November 8, imports had just risen by 269,000 barrels per day. US’ exports of crude oil also rose by 938,000 barrels per day to 4.38 million barrels per day.The four-week average was, however, sharply down by 21.8% on a year-on-year basis to 3.73 million barrels a day last week. Imports from Mexico rose by 384,000 barrels per day to 768,000 barrels a day, while those from Venezuela fell the most by 148,000 barrels per day last week. Stocks of crude oil at Cushing, Oklahoma, the delivery point for WTI crude fell by 100,000 barrels to 25.1 million barrels last week. The Strategic Petroleum Reserve in the US rose 1.4 million barrels to 389.2 million barrels as of November 15. More By This Author:Nvidia Earnings Today: Here’s What Wall Street Expects From World’s Most Valuable Company Will Gold Soar Or Stumble? Conflicting Forecasts For 2025 Oil Prices Surge On Supply Disruptions, But Contango Hints At Short-Lived Rally