The blowout January jobs report – payrolls surging, wages jumping, unemployment falling – means the Federal Reserve will be in no hurry to cut interest rates. Nonetheless, we acknowledge that this report contradicts lots of evidence elsewhere while the big drop in hours worked and growing proportion of part-time workers gives pause for thought.

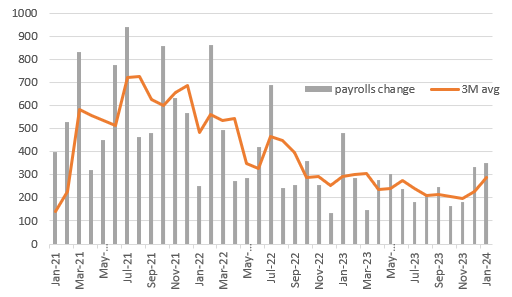

A crazy strong jobs number means the Fed will waitJanuary’s US employment report is crazy strong. Payrolls surged 353k versus 185k consensus, where the even highest forecast of 300k was well shy of the outcome, especially when we add in the 126k of upward revisions to the past two months of data. As the chart below shows, the momentum in job creation is on the rise again, but this time, it isn’t merely the leisure & hospitality, government, and education & healthcare services, which accounted for 80% of the jobs added in 2023.For sure, education and health were the biggest drivers, adding 112k, but the government added a relatively modest (by its standard) 36k jobs while leisure and hospitality saw payrolls increase just 11k. This month, we got a decent 74k increase in professional/business services plus 64k in trade & transport with 45k added in retail.US non farm payrolls monthly changes (000s) Image Source: Macrobond, ING On top of that, we have average hourly earnings rising 0.6%MoM/4.5% YoY, whereas the market had been predicting only a 0.3% increase. Meanwhile, the unemployment rate remained at 3.7% rather than rising to 3.8%. This combination of strong jobs and wages with unemployment falling indicates clear strength in the US economy and even though inflation is still tracking towards 2% the Federal Reserve simply won’t consider cutting rates at the March FOMC meeting.

Image Source: Macrobond, ING On top of that, we have average hourly earnings rising 0.6%MoM/4.5% YoY, whereas the market had been predicting only a 0.3% increase. Meanwhile, the unemployment rate remained at 3.7% rather than rising to 3.8%. This combination of strong jobs and wages with unemployment falling indicates clear strength in the US economy and even though inflation is still tracking towards 2% the Federal Reserve simply won’t consider cutting rates at the March FOMC meeting.

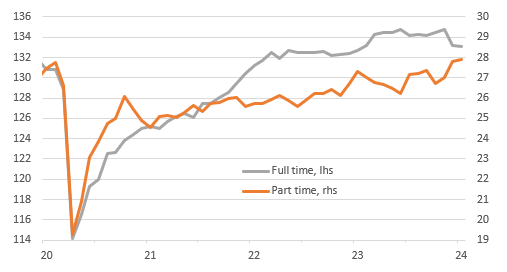

But there are areas of concern and data contradictionsHowever, we have to point out there are some less positive stories here. Nearly all the jobs the American economy is adding are part-time, and the average workweek fell to 34.1 hours – that is recession territory! Note that while the number of unemployed fell, the household survey (remember there are two surveys – the establishment survey of employers to generate the payrolls number and the household survey to generate the unemployment rate) showed employment falling 31k.Part time versus full time employment levels (millions) Image Source: Macrobond, ING

Image Source: Macrobond, ING

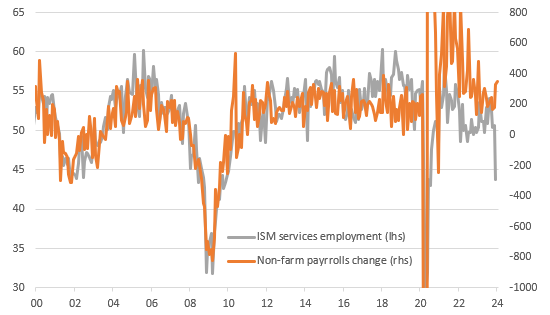

Fed will still cut rates, but nothing before MayMoreover, labor market surveys are far, far weaker, with both the ISM manufacturing and services sector surveys in contraction territory – indicating job shedding. In this regard, we will be closely watching the ISM services employment index update on Monday. It collapsed in January, and if it doesn’t dramatically rebound, then we would be worried that payrolls could soon start to roll over. Note, too, that yesterday’s NFIB hiring intentions survey was very weak. These payroll numbers can’t keep running at 300k+ given this data.ISM services employment plunge points to weakness in payrolls Image Source: Macrobond, ING So, as is the case in so much of the US data flow, there are huge contradictions between data releases and even within data releases. There will be no March interest rate cut (barring a return of financial system stress), but we are sticking with the May rate cut call with 150bp of cuts this year and 100bp in 2025.More By This Author:Asia Week Ahead: RBA And RBI Decide On Policy While Regional Players Report Inflation Key Events In Developed Markets And EMEA – Week Of Monday, February 5French Industrial Output Continues Its Rebound

Image Source: Macrobond, ING So, as is the case in so much of the US data flow, there are huge contradictions between data releases and even within data releases. There will be no March interest rate cut (barring a return of financial system stress), but we are sticking with the May rate cut call with 150bp of cuts this year and 100bp in 2025.More By This Author:Asia Week Ahead: RBA And RBI Decide On Policy While Regional Players Report Inflation Key Events In Developed Markets And EMEA – Week Of Monday, February 5French Industrial Output Continues Its Rebound

US Jobs Surge Means No March Rate Cut