The US housing recovery continues to face headwinds. Here are the key factors contributing to weakness in the sector.

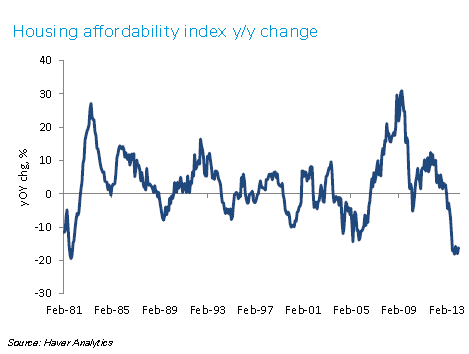

1. We’ve had a sharp decline in housing affordability due to higher prices and higher mortgage rates. The decline in mortgage rates recently should help somewhat, but buyers remain cautious.

Source: Deutsche Bank

2. Banks have tightened lending standards. The important trend here is the tightening in the “nontraditional” mortgages (ignore the “subprime” component – it’s not a meaningful portion of the market). If you don’t fit into the traditional mortgage “box”, getting a loan is now more difficult.

Senior Loan Officer Opinion Survey on Bank Lending Practices (Federal Reserve Board)

3. Household formations have stalled. It will be difficult to get the demand going until growth in households picks up again.

Source: U.S. Census Bureau

This weakness in housing is now reflected in the equity markets as shares of homebuilders underperform.

Orange=S&P500 ETF, Blue=Homebuilder index ETF (source: Ycharts)