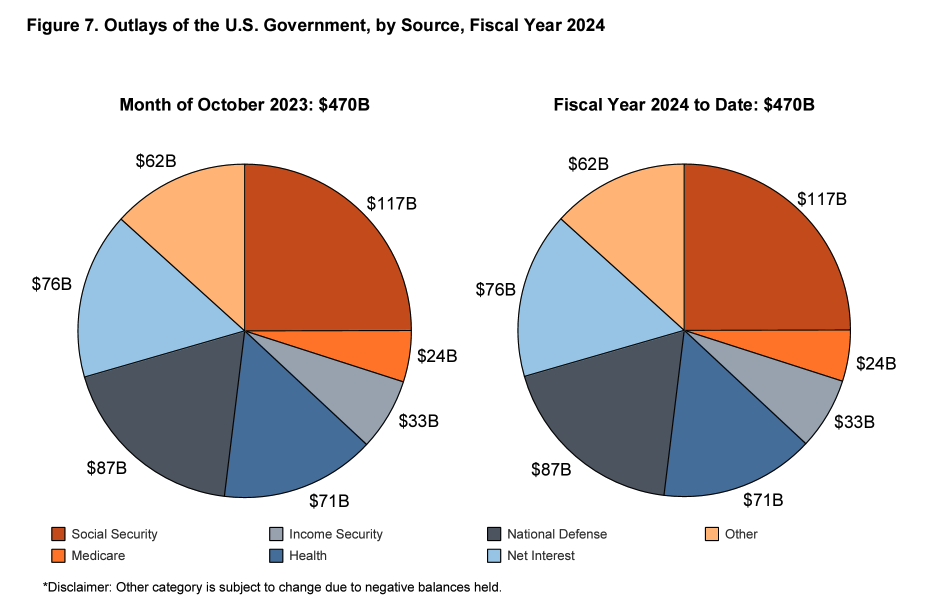

After running in fiscal 2023, the Biden administration kicked off fiscal 2024 with another big budget shortfall.The US government ran a $66.56 billion deficit in October, according to the . This was slightly lower than last year’s October shortfall of $88 billion due to record federal receipts as Americans impacted by natural disasters paid deferred tax bills.The government took in $403.43 billion in October, a 26.7% increase over last October. It was the largest influx of October federal receipts on record. This was due to a surge in tax receipts from people in California and other states who were allowed to extend their annual April tax deadline to October as they coped with natural disasters. This resulted in a 70% increase in non-withholding taxes from individuals and a whopping 170% increase in corporate tax receipts.This papered over a general downward trend in federal tax receipts through last year. Federal revenue fell by 9.3% in fiscal 2023.The federal government . According to a of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But . And government tax revenue will decline even faster as the economy spins into .Meanwhile, the Biden administration blew through $470 billion last month. Federal spending increased by 15.7% compared to October 2023.(Click on image to enlarge) This underscores the fact that the fundamental issue isn’t that the US government doesn’t have enough money. The fundamental problem is that the US government spends too much money. Despite the pretend spending cuts, didn’t address that problem. Even with the new plan in place, spending will go up. And it’s already historically high. That means big budget deficits will continue and the national debt will mount.In fact, the Biden administration is already looking for more money. The president recently proposed a $100 billion aid package for Israel, Ukraine and other “national security” priorities. No matter what you hear about spending cuts, the federal government is constantly finding new reasons to spend more money. on Sept. 15. Just 20 days later, it pushed about $33.5 trillion. In other words, the Biden administration .Most people seem to think the excessive spending, the growing deficits and the national debt don’t really matter, but somebody has taken notice. Last week, from “stable” to “negative.” This could be a prelude to a downgrade in the country’s AAA credit rating. THE BIGGER PROBLEMThis rapid increase in the national debt is happening during a time of sharply rising interest rates. This is a big problem for a government that primarily depends on borrowing to pay its bills.Interest payments on the national debt grew by $41 billion year-over-year to $88.9 billion. This accounted for about two-thirds of the October spending increase. The only spending category that was higher was Social Security. The interest expense was bigger than the amount spent on national defense and the combined total of the government-run Medicaid and Medicare health insurance programs.There is no relief in sight. There is currently about $26 trillion in outstanding Treasury securities. The average interest rate on that debt is up from 2.19% in October of last year to 3.05% today. At that number will likely quickly climb higher.A lot of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. That means interest payments will quickly climb much higher unless rates fall.Rising interest rates drove interest payments to over 35% as a percentage of total tax receipts in fiscal 2023. In other words, the government is already paying more than a third of the taxes it collects on interest expense.If interest rates remain elevated, or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt .)More By This Author:Moody’s Lowers US Credit Outlook To “Negative”Healthy correctionThe Road To Prosperity Is Paved With Credit Cards?

This underscores the fact that the fundamental issue isn’t that the US government doesn’t have enough money. The fundamental problem is that the US government spends too much money. Despite the pretend spending cuts, didn’t address that problem. Even with the new plan in place, spending will go up. And it’s already historically high. That means big budget deficits will continue and the national debt will mount.In fact, the Biden administration is already looking for more money. The president recently proposed a $100 billion aid package for Israel, Ukraine and other “national security” priorities. No matter what you hear about spending cuts, the federal government is constantly finding new reasons to spend more money. on Sept. 15. Just 20 days later, it pushed about $33.5 trillion. In other words, the Biden administration .Most people seem to think the excessive spending, the growing deficits and the national debt don’t really matter, but somebody has taken notice. Last week, from “stable” to “negative.” This could be a prelude to a downgrade in the country’s AAA credit rating. THE BIGGER PROBLEMThis rapid increase in the national debt is happening during a time of sharply rising interest rates. This is a big problem for a government that primarily depends on borrowing to pay its bills.Interest payments on the national debt grew by $41 billion year-over-year to $88.9 billion. This accounted for about two-thirds of the October spending increase. The only spending category that was higher was Social Security. The interest expense was bigger than the amount spent on national defense and the combined total of the government-run Medicaid and Medicare health insurance programs.There is no relief in sight. There is currently about $26 trillion in outstanding Treasury securities. The average interest rate on that debt is up from 2.19% in October of last year to 3.05% today. At that number will likely quickly climb higher.A lot of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. That means interest payments will quickly climb much higher unless rates fall.Rising interest rates drove interest payments to over 35% as a percentage of total tax receipts in fiscal 2023. In other words, the government is already paying more than a third of the taxes it collects on interest expense.If interest rates remain elevated, or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt .)More By This Author:Moody’s Lowers US Credit Outlook To “Negative”Healthy correctionThe Road To Prosperity Is Paved With Credit Cards?

US Government Kicks Off Fiscal 2024 With Another Big Big Budget Deficit