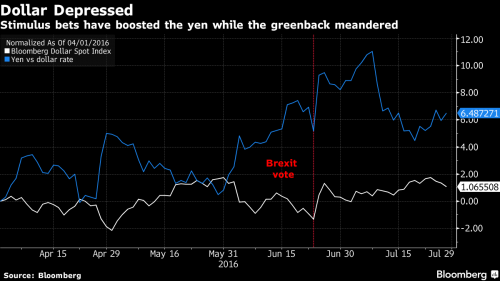

Following yesterday’s Fed decision and ahead of tonight’s far more important BOJ announcement, European stocks have posted modest declines, Asian shares rise toward 9-month highs, while U.S. equity index futures are fractionally in the green in the aftermath of Facebook’s blowout earnings. The dollar has extended on losses after Yellen reiterated a gradual approach to raising interest rates, with the BBDXY down 0.5% in early trading after slipping 0.4% over the previous two sessions.

A re-read of the Fed statement by traders, initially seen a hawkish, suggested no guidance for a September hike and as such the US currency weakened against all but two of its 16 major peers as bets on a rate hike in 2016 first rose but ultimately dropped below 50%. “We’re seeing broad dollar weakness,†said Yuji Kameoka, chief foreign exchange strategist at Daiwa. “Even though the Fed did note some improvements in the economy, a rate hike in September still isn’t certain.”Â

“The Fed detailed that they see near-term risks diminished, but read between the lines and they still see medium- and long-term risks,†said Chris Weston, chief market strategist at IG. Japan has “the fiscal spending package out of the way and that seems to be in line with the sort of upper end of expectations, but we don’t see it being a huge catalyst for markets to move materially higher.â€

Janet Yellen has repeatedly stated that the Fed is likely to raise borrowing costs gradually, though market volatility and an unexpected dip in job gains have delayed such plans. In Japan, traders are looking ahead to Friday’s monetary policy review, after Prime Minister Shinzo Abe announced a fiscal-stimulus package exceeding 28 trillion yen ($267 billion) on Wednesday in a bid to jump-start the economy.

And with the Fed now off the table, all eyes turn to Kuroda in anticipation of just what stimulus program the BOJ will announce tonight, and whether it will unveil the first case of helicopter money – in whatever form – in recent history. “The Fed’s decisions were expected,†said Mitsushige Akino of Ichiyoshi Asset Management Co. “There’ll be a tug of war between selling on expectations the BOJ will disappoint, and short covering for individual shares that will push the market up.†That indeed about sums up the market action over the past 6 months: central banks on one side, and short covering on the other.

Elsewhere, Facebook (FB) soared to new all time highs after reporting a 59% jump in sales, and miners led gains in European equities after Anglo American’s first half revenue and profit surpassed analysts forecasts.As Bloomberg once again reminds us, positive corporate earnings and signs central banks will step in to support economic growth have helped lift global equities to their biggest monthly gain since March. While admitting risks to the U.S. economy had subsided, the Fed left interest rates unchanged on Wednesday as policy makers take stock in the wake of the U.K.’s vote to leave the European Union.

Oil continues to trade near the lowest close in more than 3 months as data showed U.S. crude stockpiles unexpectedly rose, despite the following brilliant piece of insight by Citi’s Ed Morse this morning on Bloomberg TV: “We’re going to rebound, the question is timing”.Nickel led base metals higher.

Rates on Japanese notes climbed by two basis points to minus 0.275 percent. Ten-year U.S. Treasuries were little changed following last session’s six basis-point slide. And moments ago the yield British 10Y Gilts dropped to a new record low below 0.7%.

Today sees another busy session in terms of US earnings, with the likes of Mastercard (MA) and Ford (F) announcing pre-market, while after the Wall St. close, large caps Amazon (AMZN) and Alphabet (GOOG) take center stage as another 65 S&P companies report results.

Market Snapshot

- S&P 500 futures up 0.2% to 2165

- Stoxx 600 down 0.4% to 342

- FTSE 100 down 0.1% to 6742

- DAX up less than 0.1% to 10322

- German 10Yr yield down less than 1bp to -0.08%

- Italian 10Yr yield up less than 1bp to 1.21%

- Spanish 10Yr yield up less than 1bp to 1.11%

- S&P GSCI Index up 0.3% to 340.3

- MSCI Asia Pacific up 0.1% to 135

- Nikkei 225 down 1.1% to 16477

- Hang Seng down 0.2% to 22174

- Shanghai Composite up less than 0.1% to 2994

- S&P/ASX 200 up 0.3% to 5557

- U.S. 10-yr yield up less than 1bp to 1.5%

- Dollar Index down 0.63% to 96.44

- WTI Crude futures up 0.3% to $42.03

- Brent Futures down 0.2% to $43.40

- Gold spot up 0.1% to $1,342

- Silver spot down less than 0.1% to $20.35

Top Global News

- Credit Suisse (CS) Returns to Surprise Profit in 2Q: CET1 ratio rises 40 basis points to 11.8% from 1Q

- GoPro (GPRO) Beats Estimates and Forecasts Return to Profitability: co. benefited from renewed demand for action cameras ahead of introduction of a new model later this year

- Obama, Biden Say Hillary Clinton Is Only Choice: party heavyweights draw contrast between Clinton, Trump

- Obama Passes Torch to Clinton and Prepares to Run for Legacy

- Facebook Revenue, Users Top Estimates as Mobile Ads Surge: sales climb 59%, with mobile bringing in 84% of ad revenue

- Lloyds to Cut 3,000 Jobs in Expense Push After Brexit Vote: bank’s 1H underlying profit topped analyst estimates

- Suncor (SU) Swings to Loss as Alberta Wildfires Lower Production: wildfires prompted shutdown of as much as 40% of Canada supply

- Euro-Area Economic Confidence Unexpectedly Improves After Brexit:

- China Said to Legalize Uber, Didi Ride-Hailing as War Rages: Regulations to take effect November

- Adidas Raises Full-Year Forecast Amid Chelsea Payment Boost: CEO Hainer points to momentum in 2H and beyond

- AstraZeneca (AZN) Profit Drops as Focus Shifts to Newer Medicines: co. reiterates 2016 forecast with minimal currency impact

- Shell (RDS-A) Earnings Tumble to 11-Year Low on Oil, Weaker Refining: profit misses analyst estimates by more than $1b

- Cnooc Expects 1H Net Loss of About 8b Yuan

- BHP to Book Charge of as Much as $1.3b on Samarco: restart of Samarco operations now seen unlikely in 2016