European, Asian stocks fell while S&P futures rebounded as investors assessed a mixed batch of earnings reports while the dollar strengthened to 9 month highs versus most peers on rising confidence that the Fed will raise rates this year, pushing global bond yields higher.

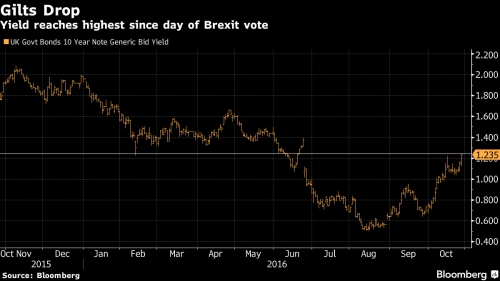

Top overnight news included the surprising profit by Deutsche Bank as well as the 35% jump in Barclays earnings on rising bond trading revenue; in macro the biggest overnight event was the UK Q3 GDP report which rose 0.5% handily beating expectations of 0.3% rise in the first quarter of Brexit. Yields on Britain’s gilts jumped to the highest since the Brexit vote. 2Y gilts rose four basis points to 0.31% in early trading and touched 0.33 percent, the highest since June 23. Germany’s 10-year bund yield climbed seven basis points to 0.15 percent, a fifth-straight increase, and Treasury 10-year note yields added three basis points to 1.82% as a December rate hike looking increasingly likely.

Norway’s krone surged after the central bank kept its benchmark interest rate unchanged for a fourth meeting. Crude oil traded below $50 a barrel amid doubts that OPEC will implement its first output cuts in eight years, further pressured by rising oil. The Bloomberg Dollar Spot Index was 0.1 percent higher. Europe’s Stoxx 600 fell 0.3 percent after rising as much as 0.5 percent.

Markets are now pricing in a 74-percent chance that the U.S. Federal Reserve will raise interest rates at its December meeting following a series of hawkish comments from Fed policymakers. Bets that the Fed will hike rates have driven the dollar to nine-month highs against a basket of currencies this week and have supported U.S. 10-year Treasury yields.

The “steepening of the US yield curve works as a magnet for capital coming at this point in particular out of low yielding environments such as Japan and Switzerland,” said analysts at Morgan Stanley, adding that these flows will continue to support the dollar.

An overnight slide in oil prices and underwhelming results from Apple soured the mood in Asian stocks where technology sectors led losses in Japan. Europe’s STOXX 600 was up 0.3 percent, however, though defensive sectors such as healthcare and utilities provided the biggest boost to the index, reflecting investor caution. Banks among the worst performing sectors in Europe this year, rose 0.5 percent helped by a surprise third-quarter profit at Deutsche Bank and forecast-beating numbers from Barclays which, like its U.S. rivals, enjoyed a significant pick-up in bond trading revenue.

Data from the European Central Bank showing lending growth to euro zone companies and households grew at a steady pace last month was also seen helping the sector.

On the earnings front it’s another busy day with 62 S&P 500 companies scheduled to release their latest quartiles including Ford Motor, ConocoPhillips and UPS either prior or at the open, and Alphabet after the close.

Bulletin Headline Summary from RanSquawk

- European equities have traded in a relatively choppy manner all morning before turning lower ahead of the US open with earnings continuing to dictate sentiment.

- A busy morning in FX, heightened by the usual month end flow — which is said to favour the USD — with the Riksbank and Norges bank rate decisions preceding the key Q3 UK GDP number which exceeded expectations

- Looking ahead, highlights US Durable Goods Orders, Weekly Jobs and Pending Home Sales

Market Snapshot

- S&P 500 futures down 0.2% to 2130

- Stoxx 600 down 0.3% to 341

- FTSE 100 down 0.2% to 6942

- DAX down 0.3% to 10674

- German 10Yr yield up 5bps to 0.14%

- Italian 10Yr yield up 5bps to 1.5%

- Spanish 10Yr yield up 5bps to 1.18%

- S&P GSCI Index up 0.4% to 372

- MSCI Asia Pacific down 0.6% to 139

- Nikkei 225 down 0.3% to 17336

- Hang Seng down 0.8% to 23132

- Shanghai Composite down 0.1% to 3112

- S&P/ASX 200 down 1.2% to 5296

- US 10-yr yield up 3bps to 1.82%

- Dollar Index down 0.03% to 98.6

- WTI Crude futures up 0.3% to $49.34

- Brent Futures up 0.6% to $50.27

- Gold spot up 0.2% to $1,269

- Silver spot up 0.1% to $17.65

Global Headline News

- Deutsche Bank (DB) Posts Surprise Profit on Trading Jump, Costs: Litigation, restructuring costs lower than analysts forecast

- Barclays Posts 35% Jump in Profit on Bond Trading Revenue: Fixed-income unit reports highest revenue in more than 2 years

- VW Struggles to Emerge From Crisis as Audi Takes Profit Hit: Audi return on sales will be ‘considerably below’ target range

- Treasury Selloff Is About to End If Consensus Forecast Is Right: Rate hike has been priced in, says Mitsubishi UFJ Kokusai

- Verizon (VZ) , Danone Pushing Company Bond Sales to Six-Week High: Borrowers rush in as borrowing premiums close to 18 month low

- Tesla (TSLA) Posts Rare Quarterly Profit as Musk Readies for SolarCity: Earnings surprise aided by cost-cutting, zero- emission credits

- Viacom Said Close to Naming International Chief Bakish CEO: Choice fills leadership void as company weighs deal with CBS

- Apple Delays AirPods Wireless Headphones Announced With IPhone 7: Didn’t provide a technical reason for the delay or indication as to when the product will be shipped