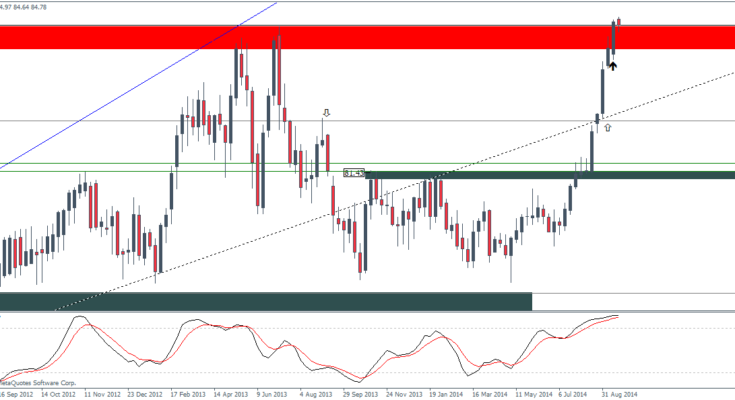

In the previous article, it was noted that there were some risks building into the US Dollar Index as it approached the key resistance level of 84.3 – 85 ahead of the FOMC minutes. Despite the perceived hawkishness of the Fed, the Dollar Index was relatively unchanged at the resistance level.

The weekly chart below shows last week’s candle closing above this resistance level, albeit very close to 84.77. This week’s candle has managed to open above this level but current price action has been pointing to some weaknesses which could either see some continued consolidation inside the resistance zone or perhaps a break lower to retest the support at 82.61.

When switching to the daily chart interval, yesterday’s candle made a higher high but overall closed lower just a notch above the resistance level making it interesting to watch today’s price action in the Dollar Index in this regards. The Stochastics oscillator continues to be overstretched into the overbought levels, but in relation the highs made by the USDX has been mostly muted.

When we zoom lower to the H4 chart interval, which is when things get interesting. The most noticeable pattern that seems to be currently playing out is a wedge pattern forming near the highs. The wedge pattern indicates weakness to the uptrend and this is aptly concurred by the Stochastics oscillator as well, which currently shows some weakness in the overbought levels. The wedge pattern gives a downside target to a few points below the resistance level of 84.25.

This is likely to put the USDX into the range of 84.05 – 83.8 levels testing the short term rising trend line, which could provide interim support to the USDX.

A break below the trend line could see further correction, eventually landing to the support zone of 82.6

Overall, the USDX looks weak unless there is a decisive close higher above the resistance level. The short term bearish corrective moves, if validated could see either a ranging price action playing out paving way for a full correction to the support level.

Dollar Index – Fundamentals

There aren’t much of economic events scheduled for this week that could give some upside momentum to the Dollar Index. The only exception being, the second quarter GDP which will be revised with an expectation of a rise to 4.6%, against the previous release of 4.2% on Friday, 26th September and the Durable goods orders which has a very bullish consensus of a rise to 0.7%, from previous declines of -0.7%, to be released on 25th of September. Any of these events missing their estimates could see the corrective downside moves coming into play. There are quite a few Fed member speeches on the tap during the week but so far it hasn’t played well into the market’s reaction as of yet.

Expect to see some bounces across the USD cross currencies, should the USDX head lower this week, which provide some additional opportunities to trade with the long term trend based off these impulsive corrective moves.