This week, the Federal Reserve issued their latest meeting minutes. They viewed the labor market positively: unemployment and initial claims for unemployment were low while wages were increasing at slightly higher rates. PCEs were growing moderately and future indicators of consumer spending were bullish.Industrial production was recently unchanged but mostly due to a drop in utility output.Business investment was still weak but recent indicators showed a slight increase. The Fed is projecting slightly higher growth due to a perceived increase in fiscal spending and an increase in price pressures due to recent increases in energy prices.Â

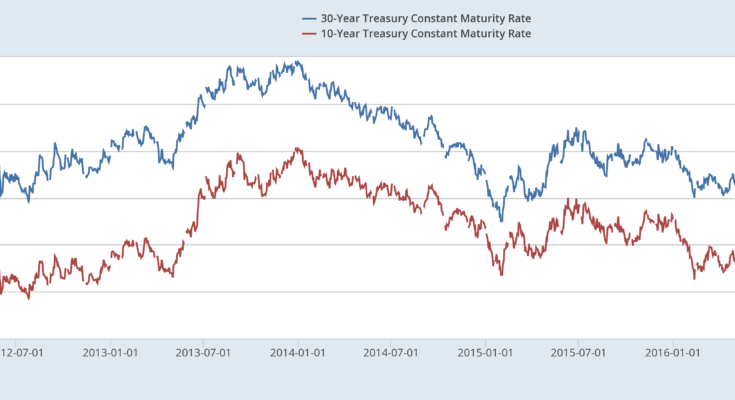

Credit markets are in strong good shape. Although rising inflation expectations (as measured by the spread between treasuries and TIPS) have led to a sell-off in the treasury market, rates are still historically low:

Corporate yields have also increased since the election:

AAA (in blue) are near 5-year highs. But BBB credit (in red) is still low by recent standards. The recent increase in yields explains higher corporate issuance since the first of the year:

Wall Street’s debt engine has begun 2017 in record form, as companies lock in borrowing costs shortly before Donald Trump’s inauguration as the US president-elect raises hopes of a stronger economy and higher interest rates.

After this week’s record start for debt sales, activity remained brisk on Wednesday with dollar deals completed by car companies Ford (F) and Toyota (TM) and banking groups Lloyds, Bank of Montreal and Citigroup (C). Earlier, Royal Bank of Canada priced a £500m sterling bond and ABN Amro issued €2.25bn of euro-denominated debt.

That followed 11 companies and banks selling $19.9bn of debt in the US on Tuesday as global financial markets reopened after the new year holiday. It marked the strongest start to a year on record, according to data from Dealogic. Global issuance totaled $21.2bn, also a record.