While the general economy continues to expand at its now famous “moderate†pace, several economic releases over the last few months indicate there are small areas of softness. Two consecutive months of weaker auto sales will likely translate into slightly lower auto sector employment in the summer or early fall. While the recently declining average monthly establishment job gains are probably a sign of full employment, they could also indicate the economy is far closer to a recession than before. These two data points indicate it’s appropriate to look at the macro-level economy to determine the probability of a recession. This column will look at the long-leading, leading and coincident indicators as well as the possibility for a macro-level commodity or financial shock. The next column will look at the itemized components of GDP to see if any undetected weakness currently exists.Â

Let’s begin with a look at the long-leading indications: Â

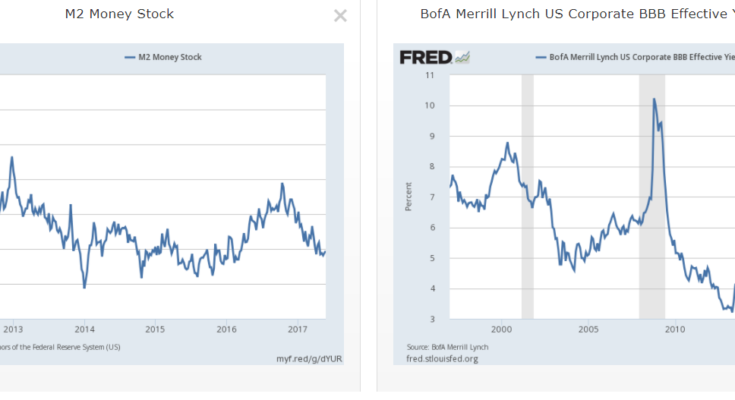

Money growth (left chart) is still positive and the more speculative yield spreads (right chart; here the BBB) are contained.

The BEA’s corporate profits number (left chart) decreased in the latest GDP reading. However, the 1Q news from Zacks and Factset was positive. The obvious difference between these two numbers is that the former includes non-publicly traded companies and is therefore broader. But the latter isolates and reports on the largest and therefore most economically important companies. But even the BEAs numbers increased in 3 of the last 5 quarters and shows no sign of contraction. Building permits (right chart) have trended between 1.1 and 1.3 million over the last 2 years. It’s possible to argue this might be a sign of the market topping out. It could also show that home builders are more conservatively managing inventory. Neither interpretation points to a contraction on the near or intermediate horizon.

The leading and coincident indicators also point to moderate growth: