I entered InvestorPlace’s Best Stocks for 2015 contest with business development company Prospect Capital (PSEC). With 2015 getting off to a rocky start, I’m feeling good about my focus on income and deep value. Prospect Capital sports a 12% dividend yield and trades for just 80% of book value. For Prospect to simply return to book value, we’d be looking at 25% returns. Add in the 12% dividend, and we’re looking at 37% returns. Chip in any special dividends–which management says is a distinct possibility–or any growth in book value, and we’re looking at returns north of 40%.

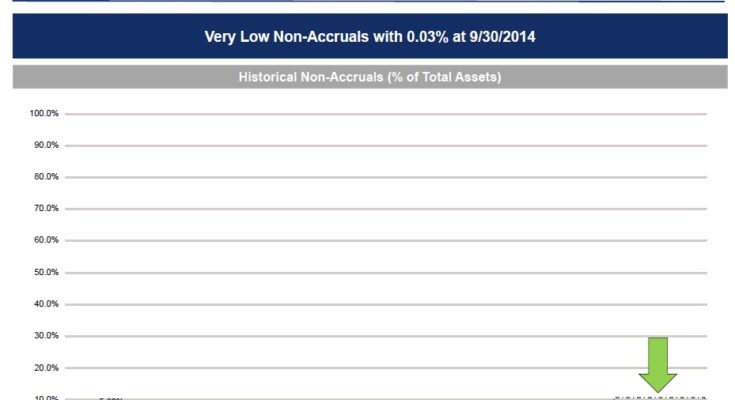

Today’s I’d like to take a quick look at Prospect’s December investor presentation and highlight a few slides I find to be particularly relevant. Let’s start with Prospect’s bad loans. As a percentage of the portfolio, they continue to trend down. In 2009, 5.8% of the portfolio was classified as “non-accrual.†Today, that number is 0.03%. The key bit of information to glean from this is that Prospect Capital has been de-risking over the past six years. I consider that a good thing. With banks essentially out of the business of lending money due to regulatory fallout and a lack of capital, BDCs like Prospect have been able to step in and make high-quality loans.

Â

Furthermore, Prospect’s portfolio is diversified across industrial sector. With crude oil prices still in freefall, it’s worth mentioning that Prospect’s exposure to oil and gas is just 4%.

Â

Meanwhile, most of Prospect’s lending is secured. 71.5% of its debt portfolio is secured by a first lien position. And another 26.3% is secured by a second lien position.

Â

All told, about 75% of its total portfolio consists of first and second lien loans.

Â

Are there risks? Sure. If we hit a rough patch in the economy, Prospect’s bad debts will creep up again. But given the massive amount of de-risking the company has done in recent years, I see that risk as being very tolerable. If anything, I would say the risk is that Prospect Capital’s portfolio isn’t risky enough. Its conservative portfolio might not allow for the kind of dividend growth investors enjoyed in previous years.