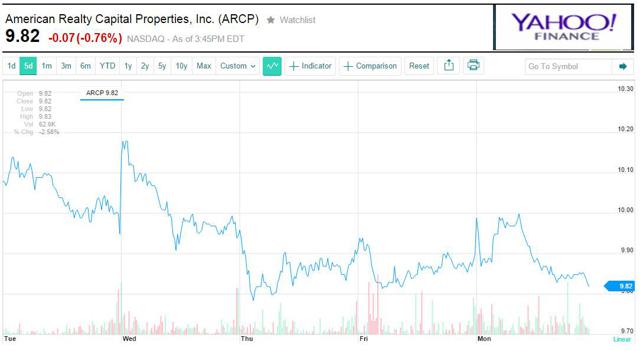

Check year-end 2014 financials off the list…check a new CEO off the list…Mr. Market seemed almost unresponsive to American Realty Capital Properties (NASDAQ:ARCP) business update today.

Don’t get me wrong, this REIT is definitely headed back up, but there are few other hurdles to clear before the stock trades north of $10.00. Let’s recap the year-end highlights:

1. Q4-14 consolidated revenue was $418.8 million, an increase of $282.6 million over the prior-year period. Year-end revenue was $1.58 billion. Here’s the breakdown of Rental Revenue and Cole Capital Income.

2. Reported consolidated FFO was ($.06) and AFFO was $.22 per diluted share for the quarter, and consolidated FFO was $.18 and AFFO was $.90 per diluted share for 2014. Here’s a chart of the historical AFFO results:

3. ARCP acquired only $21 million in Q4-14 (at a cap rate of 7.32%) and the year-end acquisition total was $3.8 billion (cash cap rate of 7.9%). ARCP sold 81 properties in Q4-14 for total net proceeds of around $1.9 billion. The majority of the disposition activity was the multi-tenant portfolio sold to Blackstone-DDR. In addition, ARCP sold a building leased to Apollo in which the company “expects to book a GAAP loss of $20 million in Q1-15″…a sign of more ahead?

Is Anyone Forgetting About the Conflicts of Interest?

ARCP’s leadership team was bullish about Cole Capital Corp.’s ability to restore its relationships with the broker-dealers that suspended sales of Cole and ARC-sponsored entities in the wake of last fall’s damaging accounting disclosure.

Interim Chairman and interim CEO Bill Stanley said that the company’s filing of 2014 year-end earnings should mark a turning point in its relationships with firms that ceased sales of certain non-traded REIT products. With the 2014 filing, the company is current with the SEC’s reporting requirements. Stanley remarked,

Our team looks forward to resuming normal operations with these business partners.