Earlier today, on the way to presenting data from the NY Fed which shows that auto loan rejection rates hit an all-time low of just 3.3% in June, we said that if one wanted to understand the circumstances that led to the housing bubble in the US, a good place to start would be the modern day auto loan market where the “originate to sell” model that characterized pre-crisis mortgage lending is alive and well. We also recommended reading a bit about the history of the GSEs, and taking “a hard look at Blythe Masters and the wizards who created the credit default swap.”

We’re not exaggerating when we say that just minutes after we penned those words – which drew an explicit link between the dynamics driving the auto loan market, the “originate to sell model” that fed Wall Street’s pre-crisis securitization machine, and the financial weapons of mass destruction that Blythe Masters helped to create – the following headline hit the wires:Â

- BLYTHE MASTERS NAMED CHAIRMAN OF SANTANDER CONSUMER USA HOLDING

That’s right, dear readers. The mother of the credit default swap is now the chairman (er, chairwoman) of Santander Consumer, the largest subprime auto lender in the country.

You cannot make this stuff up.Â

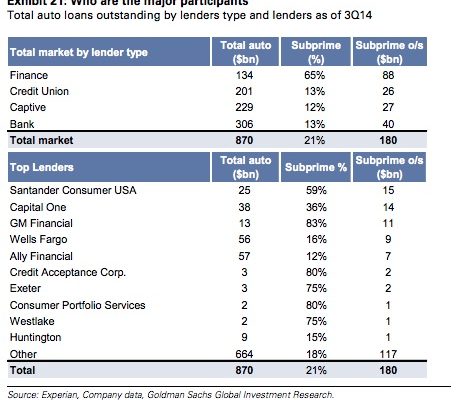

For those unfamiliar with Santander Consumer, they are the lender who, as of Q4 2014, accounted for 60% of the subprime auto market. Here’s a peek into the company’s recent trials and travails:

Santander Consumer — a unit of one of only two banks to receive the dubious honor of failing the Fed’s stress tests yesterday and the market leader in subprime auto lending — allegedly ignored a law that requires lenders to obtain a court order before repossessing cars from members of the military and will now pay $9.35 million to settle the issue with the government. Apparently, Santander illegally repoed nearly 800 vehicles from active service members over the course of 5 years and then attempted to extract fees from some 350 additional soldiers in connection with repossessions the bank didn’t even execute.Â

This is the same Santander Consumer that was subpoenaed last year by the Justice Department in connection with its packaging of subprime auto loans into ABS and whose lending practices also got the attention of the New York Dept. of Consumer Affairs.Â

Don’t think for a second that any of this is slowing down the Santander Consumer subprime auto securitization machine though. The company, which leads all other lenders when it comes to the total amount of subprime auto loan debt outstanding, has already done a deal this year worth $1.2 billion which accounts for nearly 25% of all subprime auto ABS issuance YTD.

Â