And thus ends the rally. Â Thanks to Friday’s steep selloff, all the major indices ended in the red for the week. Â While the optimists may be able to just chalk it up to a little volatility, from an unbiased, scientific point of view, there appears to be more working against the market than for it. Â That’s not to say stocks can’t rekindle the rally that was so bullish between late-2012 and March of this year, but the market’s going to have to work very hard to undo the damage that’s been done since then and get back in a bullish groove.

Our index analysis below will tell that story.  Let’s first dissect the market’s underpinnings … the recent economic data.

Economic Calendar

It wasn’t a terribly busy week in terms of economic numbers, but it was a pretty big week for real estate data, building on the real estate and construction numbers we heard a couple of weeks ago.

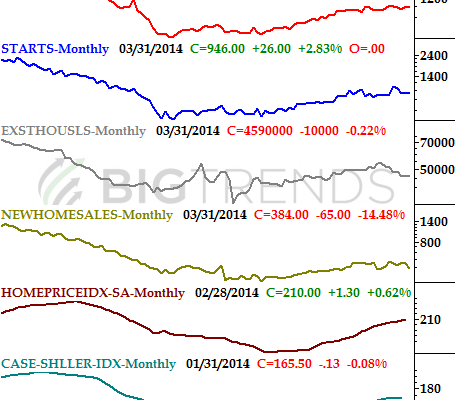

You might recall that the week before last week, housing starts and building permits were relatively flat, prolonging a lethargic period for the real estate market.  Things didn’t get any better last week on that front.  Existing home sales fell to a pace of 4.59 million, which is the lowest reading we’ve seen since late-2012.  New home sales also fell to a multi-month low pace of 384,000.  Although home prices remain modestly on the rise (according to the FHFA and Case-Shiller numbers), that doesn’t offset the fact that few homes are selling, and fewer homes are being built.

Real Estate and Construction Trends Chart

Source:Â Â Census Bureau, FHFA, Standard & Poor’s, and Briefing.com.

It wouldn’t be accurate to say the real estate market is in dire straits here, but it’s clearly no longer one of the economy’s shining stars.

Economic Calendar

Source: Â Briefing.com.Â

This week will clearly be busier one, with a huge does of employment news coming later in the week.  We’re going to hear some other big news before that, however, like April’s consumer confidence score… to be posted on Tuesday.  The Michigan Sentiment Index already jumped quite a bit for April, up to 84.1 from March’s final reading of 80.0.  The pros are thinking the Conference Board’s consumer confidence score should be up to 83.5 for April, from March’s 82.3.  Not that either measure was in jeopardy of beginning a downtrend, but an uptick here would really further solidify an already-impressive uptrend (which is great for the long-term trend, but doesn’t exactly stave off a short-term market correction).