From TradingEconomics on 10/25:

The University of Michigan consumer sentiment for the US was revised higher to 70.5 in October 2024 from a preliminary of 68.9, marking a third consecutive month of rises and reaching the highest level in six months. Both economic conditions (64.9 vs 62.7) and expectations (74.1 vs 72.9) were revised higher. This month’s increase was primarily due to modest improvements in buying conditions for durables, in part due to easing interest rates. The upcoming election looms large over consumer expectations. Overall, the share of consumers expecting a Harris presidency fell from 63% last month to 57%

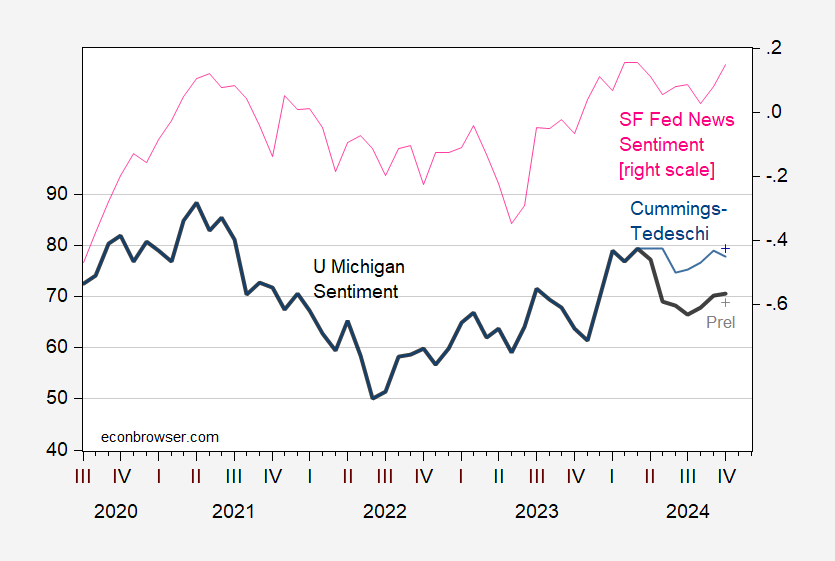

This is a slightly different take than what the had on this subject. Here’s a picture of the Michigan sentiment index, with the Cummings-Tedeschi adjustment to the preliminary series, and the implied adjustment to the final series.(Click on image to enlarge) Figure 1: UMich Consumer Sentiment (bold black, left scale), October preliminary (gray +), Consumer Sentiment adjusted per (light blue, left scale), Cummings-Tedeschi adding in final vs preliminary gap (blue +), and (scarlet, right scale), Source: University of Michigan, Cummings-Tedeschi, .

Figure 1: UMich Consumer Sentiment (bold black, left scale), October preliminary (gray +), Consumer Sentiment adjusted per (light blue, left scale), Cummings-Tedeschi adding in final vs preliminary gap (blue +), and (scarlet, right scale), Source: University of Michigan, Cummings-Tedeschi, .

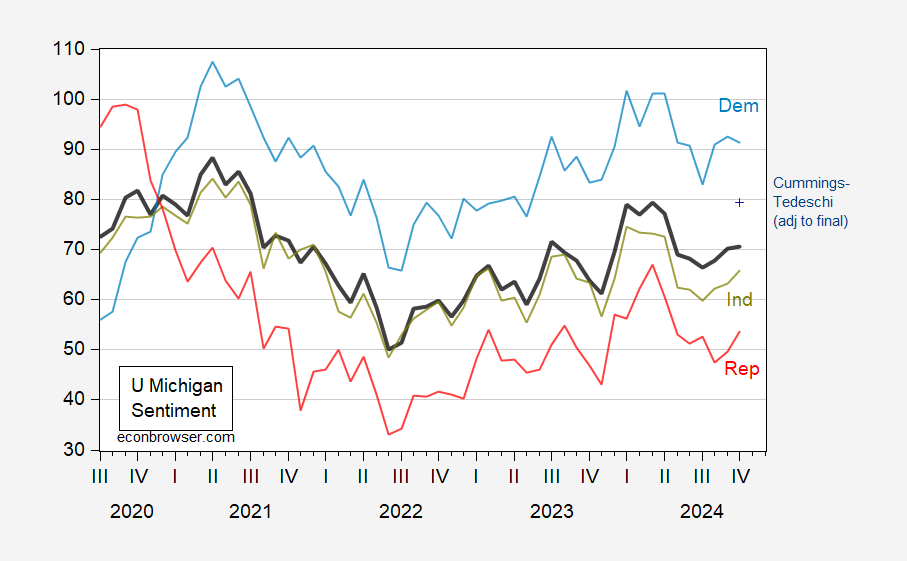

Taking the adjustment literally, this is the picture, compared to partisan group indicators (all unadjusted).(Click on image to enlarge) Figure 2: UMich Consumer Sentiment (bold black), for Democrats (light blue), for Independents (chartreuse), for Republicans (red), Cummings-Tedeschi overall sentiment adding in final vs preliminary gap (blue +). Source: University of Michigan, Cummings-Tedeschi, and author’s calculations.

Figure 2: UMich Consumer Sentiment (bold black), for Democrats (light blue), for Independents (chartreuse), for Republicans (red), Cummings-Tedeschi overall sentiment adding in final vs preliminary gap (blue +). Source: University of Michigan, Cummings-Tedeschi, and author’s calculations.

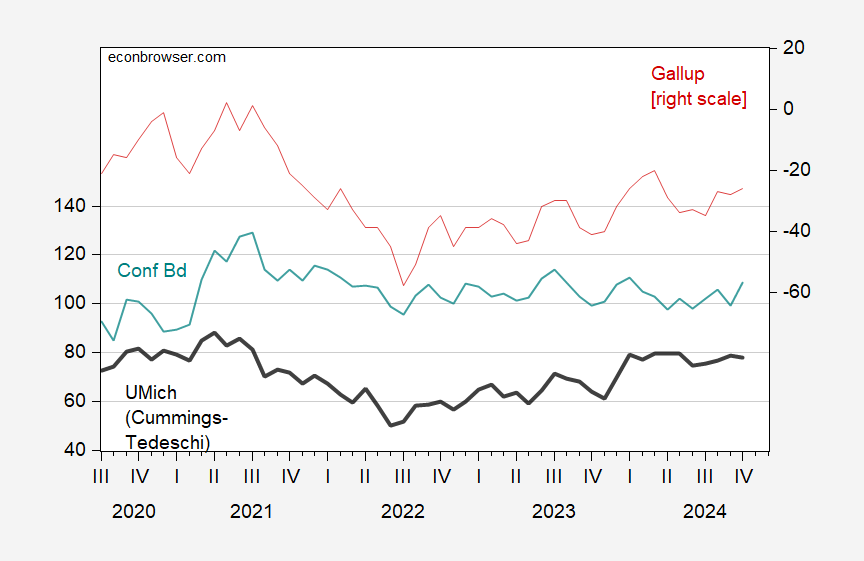

Finally, note that with the Cummings-Tedeschi adjustment, the Michigan indicator is more in line with the Conference Board and Gallup measures.(Click on image to enlarge) Figure 3: U.Michigan Sentiment adjusted to Cummings-Tedeschi April-October (bold black, left scale), Conference Board Confidence (teal, left scale), Gallup Poll (red, right scale). Source: U.Michigan via FRED, Cummings-Tedeschi, Conference Board, Gallup.More By This Author:Business Cycle Indicators As Of November’s Start The Employment Release: Downside Surprise, Signifying?Private NFP Nowcast

Figure 3: U.Michigan Sentiment adjusted to Cummings-Tedeschi April-October (bold black, left scale), Conference Board Confidence (teal, left scale), Gallup Poll (red, right scale). Source: U.Michigan via FRED, Cummings-Tedeschi, Conference Board, Gallup.More By This Author:Business Cycle Indicators As Of November’s Start The Employment Release: Downside Surprise, Signifying?Private NFP Nowcast