Ukrainian Hryvnia Crashes

Bank runs, lack of reserves, danger of default – these were the sound bites lately emanating from the post-revolutionary Ukraine. Amid reports of intensifying bank runs during which some 7% of all bank deposits have reportedly been withdrawn, Russia let it be known that it believes the Ukraine is on the brink of default. This has some weight, as Russia was poised to extend an emergency loan amounting to $15 billion to the Ukraine. Shortly after the government of former president Yanukovich and the opposition had agreed on a truce and just prior to the confrontation on Maidan square turning bloody, Russia had announced it would release a $2 billion tranche of the loan. One assumes that the Russians are well informed about the Ukraine’s financial condition. Moreover, the new interim government already let it be known that it needs at least $35 billion in aid.

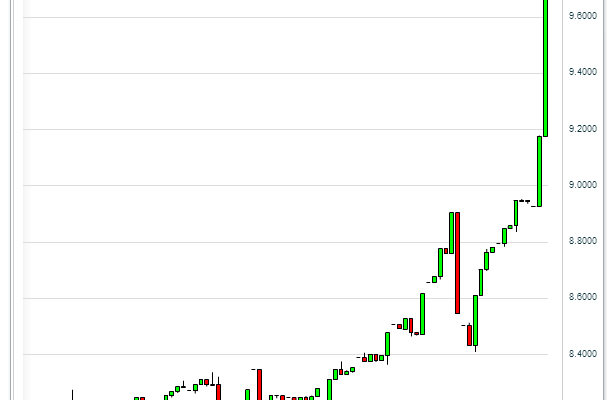

For more details on these developments see this write-up on the situation by Mish. On Monday we pointed out that the hryvnia had oddly failed to appreciate in spite of a sudden urge by investors to load up on Ukrainian stocks and bonds. Later on Monday, the currency started to move lower quite quickly. Come Tuesday, and the currency has basically crashed (and the move may not be over yet).

Â

Â

The Ukrainian hryvnia crashes – click to enlarge.

The monthly chart provides some further perspective:

The Ukrainian hryvnia monthly. One thing is certain, the revolution wasn’t good for the currency … – click to enlarge.

From the Bloomberg report linked to above:

“The markets are much too bullish now regarding Ukrainian risk assets,â€Michael Ganske, the head of emerging markets at Rogge Global Partners Plc in London, said by e-mail today. “I see the hryvnia going down further†to 12 versus the dollar.

The central bank has eased its grip on the hryvnia as it contends with slumping foreign-exchange reserves, which tumbled 28 percent in the year through January to $17.8 billion, the lowest level since 2006.â€