Executive Summary

- Over the past two decades, Canadian banks have outperformed their American counterparts.

- Lower taxes, less competition, and a robust consumer credit cycle have fuelled the Canadian rise.

- However, there are signs these tailwinds are ebbing, even reversing.

- South of the border, the U.S. has instituted a dramatic corporate tax cut which will neutralize the tax advantage Canadian banks had enjoyed versus their American competitors over the previous decades.

- In addition, American deregulation and more room for consumer credit expansion contribute to an environment where U.S. banks may be on the verge of outperforming their Canadian counterparts over the long term.

Try Googling “Canadian banks 2008 crisisâ€.

What’s the first thing that comes up? In our browser, it’s a publication from the Richmond branch of the Federal Reserve entitled, “Why was Canada Exempt from the Financial Crisis?â€

What’s the next article? A National Bureau of Economic Research piece called, “Why Canada Didn’t have a Banking Crisis in 2008.â€

Don’t forget we put no positive qualifiers into our search query, but merely stuck those four words (“Canadian banks 2008 crisisâ€) into the search engine. Instead of delivering up stories of the tumultuous year for Canadian financial markets, most results were centered on how Canadian banks performed so admirably during the global financial crisis.

The Google results should be no surprise as Canadian banks have earned reputations as terrific performers – providing solid, safe growth through good times and bad.

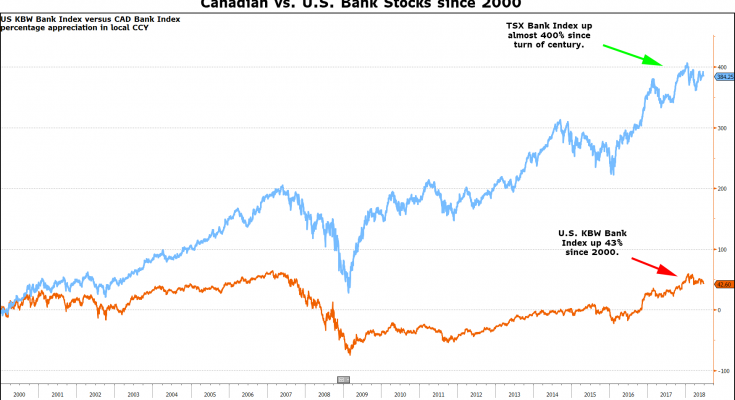

Ask market watchers about the performance of Canadian banks versus U.S. banks over the past two decades, and most would guess the Canadian bank index would be up more than the U.S. equivalent. Yet the extent of the outperformance might surprise.

Since 2000, the U.S. KBW Bank Index is up 46%. During that same period, the Canadian bank index has risen almost 400%.

And the outperformance is not solely a post-GFC (Great Financial Crisis) phenomenon. Going into the market crash, the TSX Bank Index was already up 200% versus the U.S. rise of 50%.

Canadian bank stocks have consistently outperformed their U.S. brethren for the past two decades.

Less Bank Competition in Canada

Ask a Canadian why this might be the case and they will surely answer that the bank oligopoly overcharges their customers. Although Canada has 30 official Schedule I banks, there are six main competitors that dominate most banking. Contrast that to the United States where there are almost 6,800 FDIC insured commercial banks. There is little doubt this dramatic difference in competition is a factor contributing to some of the Canadian bank outperformance.

Examining the return-on-capital of the two countries’ bank sectors shows Canadian banks earning more.

Not only have Canadian banks consistently earned almost 100 basis points more, but during the GFC, they managed to avoid the gut-wrenching negative returns that plagued U.S. banks.

There can be little surprise as to why Canadian bank stocks have outperformed their American neighbors over the past couple of decades. Â Canadian banks have earned more and lost less.

Canadian Consumer Credit Bubble

Some might say this is due to the large consumer debt bubble that has manifested in Canada. Although both countries’ household-debt-to-GDP ratios were approximately the same in the early 2000s after the GFC Canadians went on a borrowing binge that took the household-debt-to-GDP ratio to new highs.

During this same period, the American household-debt-to-GDP ratio fell from almost 100% to 75%.

It’s much easier for a bank to make money with a consumer credit expansion tailwind at its back. In this environment clients are buying houses, taking out new credit cards and in general, continually expanding the amount of banking they require.

This credit expansion has helped fuel a striking housing bull market.

The ever-rising Canadian home prices has been a large factor in keeping Canadian bank loan losses low. A bull market hides a lot of lending mistakes.

Tax Rate Surprise

Yet the real secret to the Canadian bank index outperformance is not confined to simply earning a better return from operations.