USD/JPY falls ahead of US non-farm payroll data

USD/JPY is edging higher after two days of losses but is still on track to lose around 1% across the week as investors look ahead to U.S. jobs data to gauge how soon the Fed could start easing interest rates.The closely watched non-farm payroll report is due to be released later today and is expected to show that 180,000 jobs were added in January, down from 216,000 in December. Meanwhile, unemployment is expected to tick higher to 3.8%, up from 3.7%, and average earnings growth is expected to hold steady at 4.1%.Data comes after the ADP payroll report was softer than expected, which, as a lead indicator, suggests a possible miss for NFP numbers. Weaker-than-expected jobs data could see investors increase expectations of a March interest rate cut back up to around the 50/50 level.Following the FOMC rate decision early in the week, the market is pricing in a 35% chance for a Fed rate cut in March. This is compared to around 85% at the end of December; meanwhile, a May rate cut is almost fully priced in.This week, the yen has been supported by the Bank of Japan’s January meeting minutes, which showed policymakers discussed the possibility of a near-term move away from negative interest rates. Policymakers have a growing view that conditions are falling into place to end accommodative monetary policy.

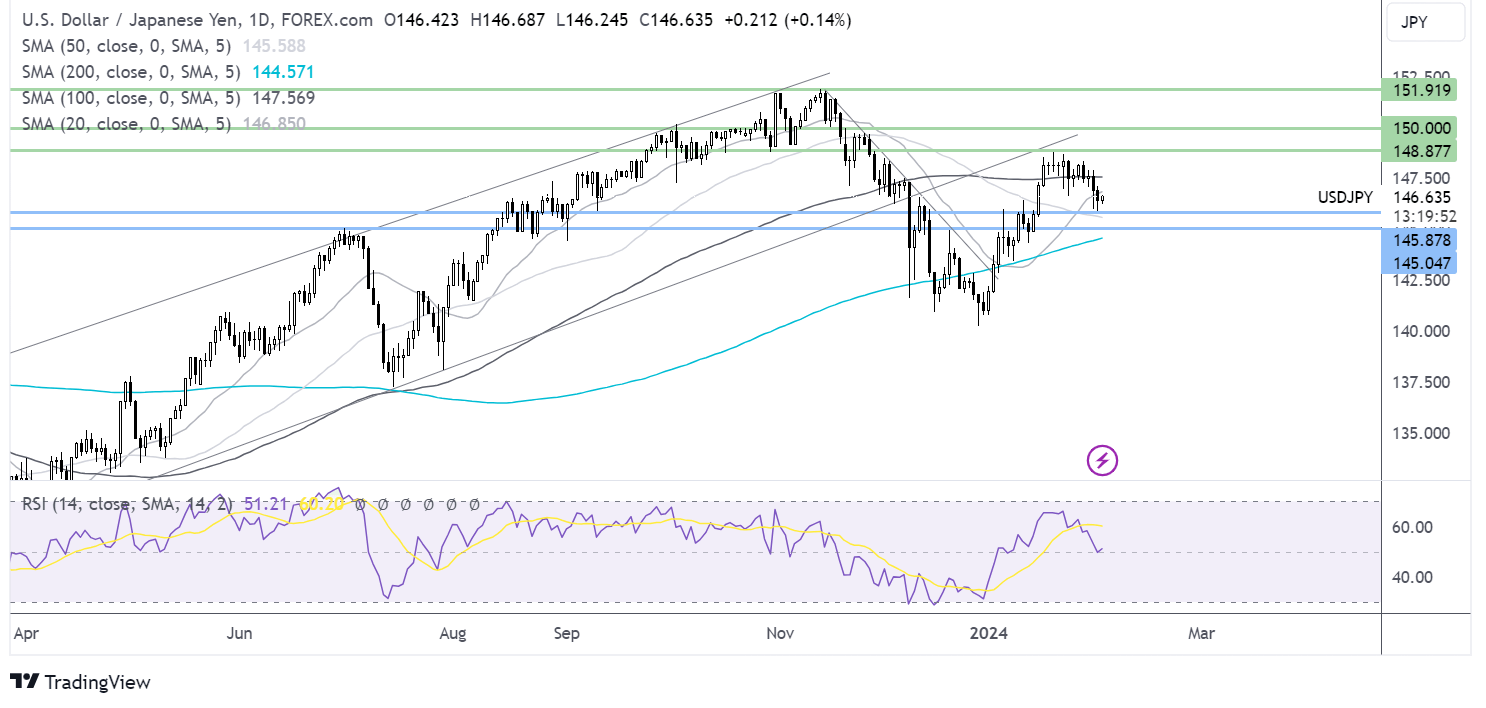

USD/JPY forecast – technical analysisUSD/JPY ran into resistance at 148.80 and had been consolidating around the 100 SMA at 147.50. The price broke below the 100 SMA finding support at 145.80. The RSI is neutral.Sellers will look to take out 145.80 to create a lower low towards 145.00 the June high, before exposing the 200 SMA at 144.50.Meanwhile, buyers could look for a rise above the 100 SMA at 147.50 to build a recovery towards 148.80. A rise above here creates a higher high and brings 150.00 into focus.(Click on image to enlarge)

Oil is set for a steep weekly loss

Oil prices are edging higher on Friday after a decision by OPEC to keep its oil output policy unchanged. However, oil prices are headed for a weekly loss amid signs of calming tensions in the Middle East, easing supply disruption worries.OPEC+ sources say the group has kept its oil output policy unchanged. The next decision, whether or not to extend voluntary oil production cuts, will take place in March. The oil cartel currently has output cuts of 2.2 million barrels per day for the first three months of this year.Still, oil prices are heading for a weekly loss of around 5% amid rumors of an Israel and Hamas Ceasefire Agreement. Investors are optimistic that a truce in Gaza would stop the Houthi attacks on Red Sea shipping, which has disrupted global trade and oil flows.However, these rumors remain unsubstantiated, with a Qatari official saying there was no ceasefire.Looking ahead, attention will be on US non-farm payrolls for further clues into the health of the US economy and ideas.

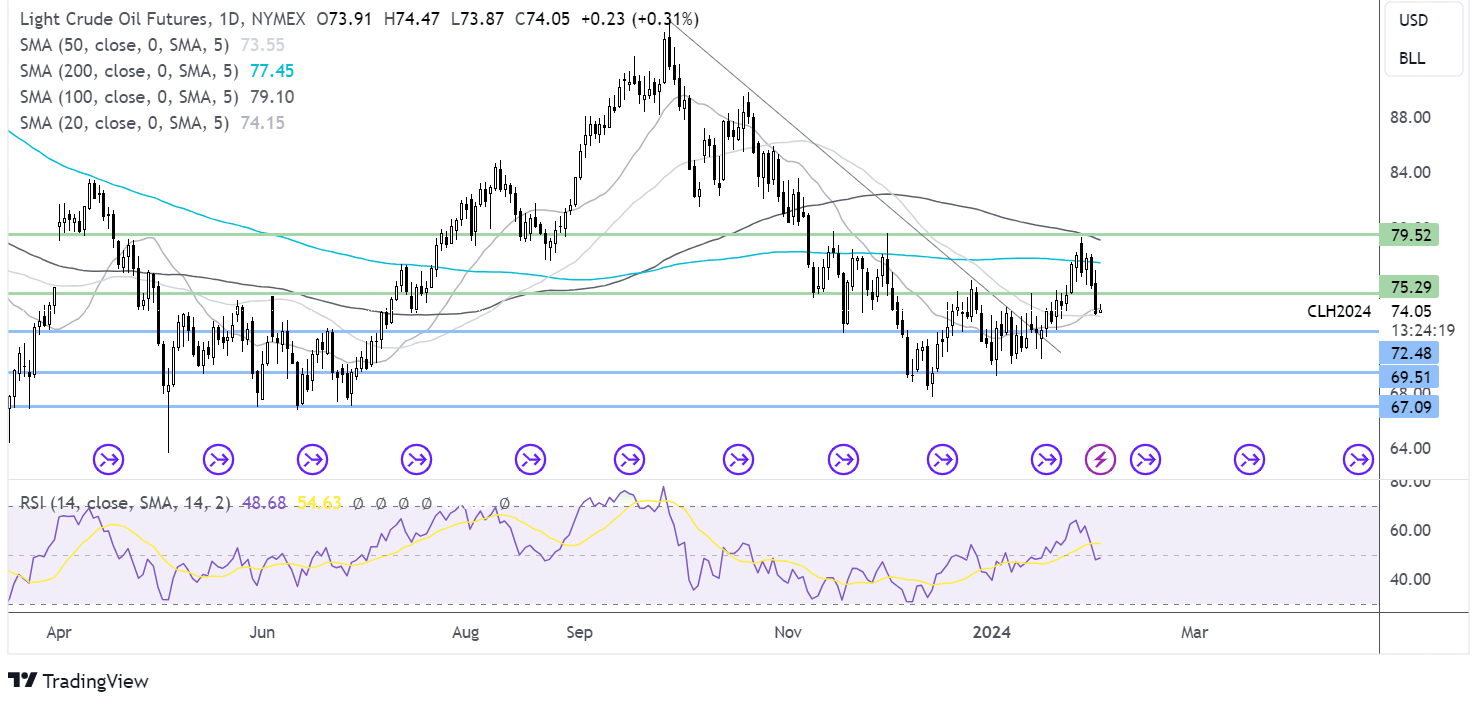

Oil forecast – technical analysisAfter running into resistance just below 80.00, the price rebounded lower, falling below the 200 SMA, the key support, and is testing the 20 SMA at 74.15.Sellers will need to take out this level to bring 72.50 support into focus and 70.00 the round number.Should the 20 SMA hold, buyers will look to retake the 75.20 resistance ahead of the 200 SMA at 77.50. Above here the 80.00 comes back into focus.(Click on image to enlarge) More By This Author:Two Trades To Watch: GBP/USD, EUR/USD – Thursday, Feb. 1 Two Trades To Watch: EUR/USD, Oil – Friday, Jan. 26Two Trades To Watch: DAX, USD/JPY – Thursday, Jan. 25

More By This Author:Two Trades To Watch: GBP/USD, EUR/USD – Thursday, Feb. 1 Two Trades To Watch: EUR/USD, Oil – Friday, Jan. 26Two Trades To Watch: DAX, USD/JPY – Thursday, Jan. 25