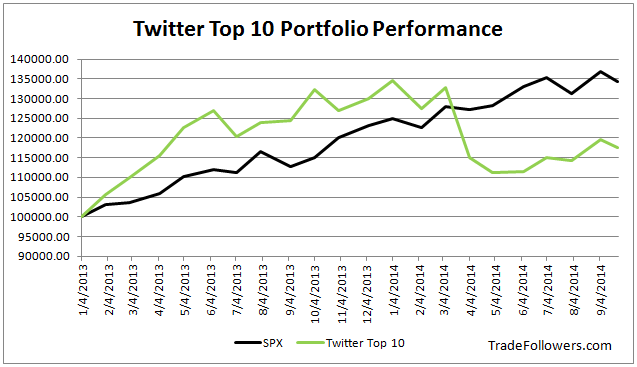

The Twitter Top 10 portfolio is slightly down this month and is performing similar to the S&P 500 Index SPX. The only real leader this month is Bank of America BAC up over 5%. The drags on the portfolio are Achillion Pharmaceuticals ACHN down almost 10%, JC Penney JCP down 8%, and Netflix NFLX down 6%. One thing that is interesting is that the stocks aren’t getting crushed…yet. This portfolio tends to hold momentum names so they out perform in up trends and under perform ahead of and in down trends. So keep an eye on theses stocks as a guide to the market. Maybe most of the froth came out of the momentum names earlier during the January to April decline.

Below is a performance chart and details of the current holdings.

Â

Â

| Start Date | Symbol | Shares | Start Price | Start Total | End Price | End Total | % Gain / Loss |

| 9/5/2014 | $TWTR | 279 | 50.70 | 14145.30 | 52.21 | 14566.59 | 2.98% |

| Â | $FB | 174 | 77.26 | 13443.24 | 78.25 | 13615.50 | 1.28% |

| Â | $NFLX | 24 | 475.68 | 11416.32 | 446.03 | 10704.72 | -6.23% |

| Â | $GILD | 118 | 105.36 | 12432.48 | 107.52 | 12687.36 | 2.05% |

| Â | $JCP | 1027 | 11.08 | 11379.16 | 10.20 | 10470.27 | -7.99% |

| Â | $ACHN | 935 | 12.17 | 11378.95 | 11.00 | 10285.00 | -9.61% |

| Â | $BAC | 710 | 16.02 | 11374.20 | 16.91 | 12006.10 | 5.56% |

| Â | $GOOG | 19 | 586.08 | 11135.52 | 577.00 | 10963.00 | -1.55% |

| Â | $BIDU | 51 | 226.07 | 11529.57 | 217.22 | 11078.22 | -3.91% |

| Â | $YHOO | 287 | 39.59 | 11362.33 | 39.14 | 11233.18 | -1.14% |

| Â | Cash | Â | Â | 2.53 | Â | 2.53 | Â |

| Â | Â | Â | Â | Â | Â | Â | Â |

| Totals | Â | Â | Â | 119599.60 | Â | 117612.47 | -1.66% |