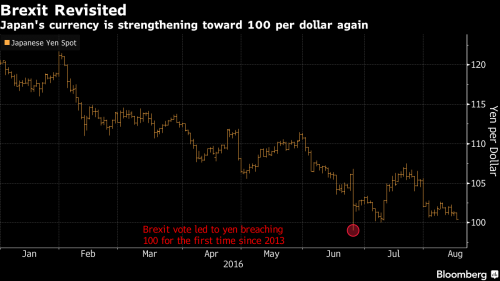

Overnight, John Williams’ latest uberdovish paper “Monetary Policy in a Low R-star World”, which we profiled yesterday, and which suggests lower rates for far longer, made the rounds and has led to a steep 0.8% drop in the Bloomberg Dollar spot Index, which sank to its weakest since June while the yen strengthened 1.2 percent, slipping briefly below 100 against the greenback, dropping as low as 99.95 for the first time since June 24, pushing oil and gold higher, and Asian shares lower.

The dollar is losing ground as lackluster data in the world’s biggest economies fuel speculation the Fed will refrain from raising interest rates. The Citigroup Inc. U.S. Economic Surprise Index, which measures whether data beat or miss analyst forecasts, reached the lowest in more than a month. As a result, the latest surge in the Yen, noted overnight when various stops were tripped, sent the Nikkei sharply lower by 1.6%, and has put further pressure on the BOJ to come devalue its currency. “The yen is being driven by the dollar’s weakness, spurred by increasing expectations the Federal Reserve won’t raise rates this year,†said Nicholas Teo, a strategist at KGI Fraser Securities in Singapore. “This complicates things for Japanese policy makers seeking to stimulate Japan’s economy. If the Fed doesn’t move this year, there’s a risk of steeper moves next year. That’s very dangerous.â€

“The unevenness seen over the last couple of weeks in U.S. data has diminished the relative appeal of pursuing dollar strength,†said Ned Rumpeltin, the European head of foreign-exchange strategy at Toronto Dominion Bank in London. Minutes of the last Fed meeting due this week “will be an important platform to signal whether they hope to keep the potential for a 2016 rate hike on their agenda, although markets think that chance is fairly remote right now.â€

The pound jumped as U.K. inflation accelerated in July more than economists predicted. Precious metals advanced while European stocks slipped.

Global stocks were modestly lower pressured by rising local currencies, and edged away from one-year peaks on Tuesday as a stellar rally stalled, while the dollar hit a one-month low against the yen as recent weak U.S. economic data was seen limiting the scope for a near-term rate hike. Asian shares rose to a one-year peak, lifted by a rise in U.S. stocks to record highs a day earlier and expectations that monetary policy around the world will remain lower for longer than anticipated to support growth. But, in a sign that the rally in world shares may be losing momentum, Chinese stocks pulled back from seven-month highs following a sharp correction in bank shares and Japan’s Nikkei fell more than 1.5 percent to its lowest level in just over a week as the yen firmed.

Meanwhile, the skepticism over the low-volume levitation remains: “If you look at the previous days, we had upturns every couple of days, but not based on healthy volumes — that’s very often a sign that the reaction in the other direction could follow,†said Soeren Steinert, an associate director for equities trading at Quoniam Asset Management, which oversees the equivalent of $29 billion. “There’s an increasingly lower probability of a Fed rate hike this year, and that’s priced in. Brexit you don’t hear about any more. And the earnings season is over, so what’s the trigger for the upside?â€

Quoted by Reuters, Michael Hewson, chief market analyst at CMC Markets said that “Equity markets are looking a bit frothy and what’s dragging them down is a bit of softness in the oil price and yen strength.Investors are a bit nervous but ultimately in a low-yield world, stocks remain a decent bet for yield.” That’s ok, that’s what central banks are there for: to ease investor nerves.

While European shares opened broadly lower, edging away from Monday’s seven-week highs as markets in London, Paris and Frankfurt slipped 0.4-0.9 percent in early trade, they have since rebounded somewhat and the the Stoxx Europe 600 Index was trading about 0.1% lower.Schindler Holding AG led industrial-goods companies lower, sliding 3.6 percent after forecasting a decline in the global elevator and escalator market. Electrolux AB, which gets more than a third of its revenue from North America, lost 2.1 percent after a report showed U.S. shipments of major home appliances fell in July. Antofagasta Plc helped push a measure of commodity producers to the best performance of the 19 industry groups on the Stoxx 600, climbing 3.4 percent. The company said first-half earnings rose and announcing an interim dividend of 3.1 cents a share. Linde AG jumped 5.8 percent, propelling a gauge of chemical stocks higher, after people familiar with the matter said Praxair Inc. has held merger talks with the German industrial-gas company.

S&P 500 Index futures were little changed, with the index having risen to fresh highs on Monday.

In the commodity complex, oil gained, after erasing an earlier loss as the weakness in the dollar overtook speculation that the Organization of Petroleum Exporting Countries will struggle to agree any kind of limit on production next month. West Texas Intermediate crude advanced 0.7 percent to $46.04 a barrel and Brent gained 0.5 percent to $48.58. And speaking of OPEC, after Nigeria overnight expressed doubt any supply cut would take place, when Nigerian petroleum minister Emmanuel Kachikwu said that “on oil production cuts by OPEC, optimism on my part is quite sparse but I believe engagement with the 70% oil producers might have impact,” earlier today Iran also poured cold water over expectations of a September production freeze: