The market closed flat to up on Monday, maintaining some of last week’s positive momentum, but continued conflict in the Ukraine and the Hamas Gaza war are doing their part to keep investors on edge. That, as well as uncertainty about prospects for Q4 are halting any major thrusts forward. Yesterday the S&P 500 closed at 4,366, up 8 points, the Dow closed at 34,096, up 35 points and the Nasdaq Composite closed at 13,519, up 41 points.

Yesterday the S&P 500 closed at 4,366, up 8 points, the Dow closed at 34,096, up 35 points and the Nasdaq Composite closed at 13,519, up 41 points. Chart: The New York TimesMost actives were led by Tesla (), down 0.3%, followed by Apple (), up 1.5%, and Advanced Micro Devices (), down 0.4%.

Chart: The New York TimesMost actives were led by Tesla (), down 0.3%, followed by Apple (), up 1.5%, and Advanced Micro Devices (), down 0.4%. Chart: The New York TimesCurrently, in morning futures trading, S&P 500 market futures are trading down 13 points, Dow market futures are trading down 98 points, and Nasdaq 100 market futures are trading down 41 points.TalkMarkets contributor in his , a TM “In the Spotlight” column writes:”Market indecision in the wake of the anticipated rebound of the past week, is pretty evident. At this point the market has not succumbed to what some of us think may be a foreboding situation in the Middle East (possibly Ukraine as well)…Doubts if it’s wise to chase the upside even if able to extend a bit more. It’s not so much ‘run with or run from’ the rally, as we had it, short covering was part, seasonal lows too, but there’s just too much challenging it to suggest anything more than we did: nibble two weeks ago and stand aside on surges, only buying on purges.From a technical perspective, the market held where it needed to on a break of S&P 4200, then you got interest rate stabilization, both of which we looked for…There’s no particular catalyst to extend the upside, other than seasonal norms that are common, but we need more for anything stronger. That makes Powell remarks later this week needed to ‘calm’ anxiety on the financial side, or not, so we’ll see. And if there were something solid from Semiconductors but not a further run-up in Oil, would also help. Neither is assured this week…”

Chart: The New York TimesCurrently, in morning futures trading, S&P 500 market futures are trading down 13 points, Dow market futures are trading down 98 points, and Nasdaq 100 market futures are trading down 41 points.TalkMarkets contributor in his , a TM “In the Spotlight” column writes:”Market indecision in the wake of the anticipated rebound of the past week, is pretty evident. At this point the market has not succumbed to what some of us think may be a foreboding situation in the Middle East (possibly Ukraine as well)…Doubts if it’s wise to chase the upside even if able to extend a bit more. It’s not so much ‘run with or run from’ the rally, as we had it, short covering was part, seasonal lows too, but there’s just too much challenging it to suggest anything more than we did: nibble two weeks ago and stand aside on surges, only buying on purges.From a technical perspective, the market held where it needed to on a break of S&P 4200, then you got interest rate stabilization, both of which we looked for…There’s no particular catalyst to extend the upside, other than seasonal norms that are common, but we need more for anything stronger. That makes Powell remarks later this week needed to ‘calm’ anxiety on the financial side, or not, so we’ll see. And if there were something solid from Semiconductors but not a further run-up in Oil, would also help. Neither is assured this week…” Contributor in an “Editor’s Choice” piece notes .”With Q3 results from more than 80% of S&P 500 members already out, we can confidently say that actual results have once again turned out to be better than expected. Keep in mind that Q3 earnings estimates had barely budged ahead of the start of the reporting cycle, which makes the outperformance all the more significant.We continue to be of the view that while the overall earnings picture isn’t great, it isn’t falling off the cliff either. In fact, Q3 earnings growth is on track to turn positive, which follows three back-to-back quarters of declines.On the negative side, the Q3 results show a notable loss of momentum on the revenues side, both in terms of the growth rate as well as the proportion of these companies beating top-line expectations.An even more disconcerting development is on the revisions front, with estimates for the current (2023 Q4) and coming quarters starting to come down, which follows a relatively stable revisions trend over the preceding six months.”

Contributor in an “Editor’s Choice” piece notes .”With Q3 results from more than 80% of S&P 500 members already out, we can confidently say that actual results have once again turned out to be better than expected. Keep in mind that Q3 earnings estimates had barely budged ahead of the start of the reporting cycle, which makes the outperformance all the more significant.We continue to be of the view that while the overall earnings picture isn’t great, it isn’t falling off the cliff either. In fact, Q3 earnings growth is on track to turn positive, which follows three back-to-back quarters of declines.On the negative side, the Q3 results show a notable loss of momentum on the revenues side, both in terms of the growth rate as well as the proportion of these companies beating top-line expectations.An even more disconcerting development is on the revisions front, with estimates for the current (2023 Q4) and coming quarters starting to come down, which follows a relatively stable revisions trend over the preceding six months.” “For the quarter as a whole, combining the actuals for these 405 companies with estimates for the still-to-come 95 index members, Q3 earnings are on track to increase by +1.5% on an equivalent growth in revenues.”

“For the quarter as a whole, combining the actuals for these 405 companies with estimates for the still-to-come 95 index members, Q3 earnings are on track to increase by +1.5% on an equivalent growth in revenues.” “Estimates for the current and coming quarters have started coming down in a significant way over the last few weeks.The expectation currently is for 2023 Q4 earnings to be up +1.9% from the same period last year on +2.7% higher revenues. This growth pace represents a notable decline from what was expected for the period in late September of +5.3% earnings growth on +3.6% higher revenues.The cuts to Q4 earnings estimates are widespread, with estimates getting cut for 11 of the 16 Zacks sectors. The sectors suffering the biggest cuts include Autos, Medical, Transportation, and Consumer Discretionary.On the positive side, estimates have increased for the Energy, Utilities, Industrials, and Retail sectors.Estimates for the Tech sector have modestly gone up, a significant deceleration from the pace of positive estimate revisions that we saw in the last two quarters.”See the full article for additional charts and details.TM contributor contributes this quip in his article .”Blackrock () official says stocks are in a really good place, not too Fed hot, not too economy cold. Total Goldilocks. Equity investors, however, tend to fall into these cyclical traps. It will just be weak enough to back up Jay Powell, but not too weak as to cause major damage. And if the landing does get too hard, that the Fed can always cut rates to save the day.A word of caution: the landings are always hard and the Fed never saves the day.”A recession watch comes from this chart by economist and TalkMarkets contributor whose data shows .”Does this mean we should be expecting the recession, in next month’s or month after’s data? Maybe, maybe not.”

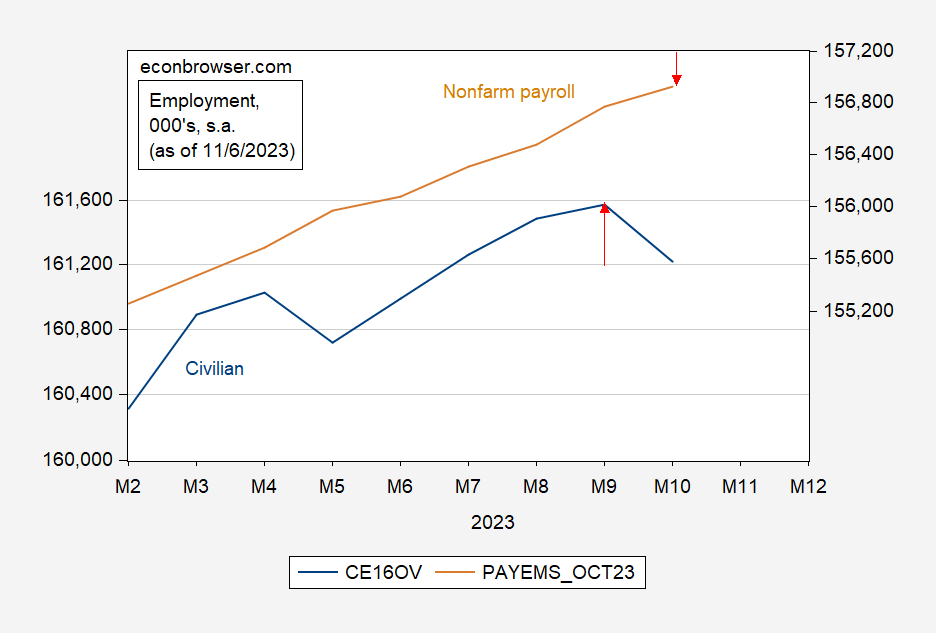

“Estimates for the current and coming quarters have started coming down in a significant way over the last few weeks.The expectation currently is for 2023 Q4 earnings to be up +1.9% from the same period last year on +2.7% higher revenues. This growth pace represents a notable decline from what was expected for the period in late September of +5.3% earnings growth on +3.6% higher revenues.The cuts to Q4 earnings estimates are widespread, with estimates getting cut for 11 of the 16 Zacks sectors. The sectors suffering the biggest cuts include Autos, Medical, Transportation, and Consumer Discretionary.On the positive side, estimates have increased for the Energy, Utilities, Industrials, and Retail sectors.Estimates for the Tech sector have modestly gone up, a significant deceleration from the pace of positive estimate revisions that we saw in the last two quarters.”See the full article for additional charts and details.TM contributor contributes this quip in his article .”Blackrock () official says stocks are in a really good place, not too Fed hot, not too economy cold. Total Goldilocks. Equity investors, however, tend to fall into these cyclical traps. It will just be weak enough to back up Jay Powell, but not too weak as to cause major damage. And if the landing does get too hard, that the Fed can always cut rates to save the day.A word of caution: the landings are always hard and the Fed never saves the day.”A recession watch comes from this chart by economist and TalkMarkets contributor whose data shows .”Does this mean we should be expecting the recession, in next month’s or month after’s data? Maybe, maybe not.” Figure 1: Civilian employment over age 16 (blue, left log scale), nonfarm payroll employment (tan, right log scale), both in 1000’s, seasonally adjusted, both as of 11/3/2023. Source: BLS via FRED.“Consulting the currently available data over the past four recessions, one would find that in two cases the household series peaks before the establishment — in one case three months earlier. However, the results are somewhat different in real time, i.e., as observers were contemporaneously assessing the onset of a recession.”See Chinn’s full work up for additional charts and details.Closing out our round-up of cautious predictions for the stock market and the U.S. economy, contributor finds .”The Federal Reserve’s Senior Loan Officer Opinion Survey shows banks have tightened lending standards further while households and businesses remain wary of taking on additional borrowing. Given how important credit flow is to the US economy it makes it all the more likely that the economy will continue to slow, helping to bring inflation back to target.”

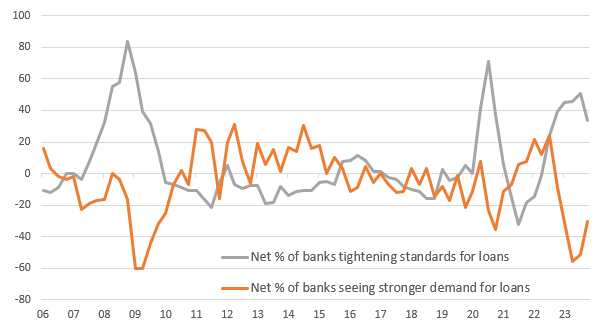

Figure 1: Civilian employment over age 16 (blue, left log scale), nonfarm payroll employment (tan, right log scale), both in 1000’s, seasonally adjusted, both as of 11/3/2023. Source: BLS via FRED.“Consulting the currently available data over the past four recessions, one would find that in two cases the household series peaks before the establishment — in one case three months earlier. However, the results are somewhat different in real time, i.e., as observers were contemporaneously assessing the onset of a recession.”See Chinn’s full work up for additional charts and details.Closing out our round-up of cautious predictions for the stock market and the U.S. economy, contributor finds .”The Federal Reserve’s Senior Loan Officer Opinion Survey shows banks have tightened lending standards further while households and businesses remain wary of taking on additional borrowing. Given how important credit flow is to the US economy it makes it all the more likely that the economy will continue to slow, helping to bring inflation back to target.” ” Banks tightened lending standards through the third quarter and saw further weakening in demand for loans across the board. The net proportion of banks tightening lending standards to medium and large firms came in at 33.9% in 3Q versus 50.8% in 2Q. Importantly these are incremental changes – we need to remember the 33.9% is over and above the 50.8% of banks tightening in 2Q. Consequently, the wording of the report states, “survey respondents, on balance, reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories”. Similarly, for lending to households “lending standards tightened across all categories of residential real estate (RRE) loans… In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Moreover, for credit card, auto, and other consumer loans, standards reportedly tightened, and demand weakened on balance”…Demand for loans has also weakened further, underscoring the likelihood that lending growth turns negative in the US.”

” Banks tightened lending standards through the third quarter and saw further weakening in demand for loans across the board. The net proportion of banks tightening lending standards to medium and large firms came in at 33.9% in 3Q versus 50.8% in 2Q. Importantly these are incremental changes – we need to remember the 33.9% is over and above the 50.8% of banks tightening in 2Q. Consequently, the wording of the report states, “survey respondents, on balance, reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories”. Similarly, for lending to households “lending standards tightened across all categories of residential real estate (RRE) loans… In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Moreover, for credit card, auto, and other consumer loans, standards reportedly tightened, and demand weakened on balance”…Demand for loans has also weakened further, underscoring the likelihood that lending growth turns negative in the US.” Macrobond, ING” The reasoning for banks’ tightening of lending standards included “a less favorable or more uncertain economic outlook; a reduced tolerance for risk; a deterioration in the credit quality of loans; concerns about funding costs; a deterioration of customer collateral values; concerns about the adverse effects of legislative changes, supervisory actions, or changes in accounting standards; concerns about deposit outflows; and a deterioration in or desire to improve their liquidity positions”…Given the importance of credit flow to the US economy we fear the optimism regarding a potential “soft landing” may be misplaced with the Fed potentially needing to reverse course and start cutting interest rates more aggressively than currently priced. We see upwards of 150bp of rate cuts in 2024 versus the market pricing of around 90bp.”That’s a wrap for today.Hope there will be better news to come later in the week.Have a good one.More By This Author:

Macrobond, ING” The reasoning for banks’ tightening of lending standards included “a less favorable or more uncertain economic outlook; a reduced tolerance for risk; a deterioration in the credit quality of loans; concerns about funding costs; a deterioration of customer collateral values; concerns about the adverse effects of legislative changes, supervisory actions, or changes in accounting standards; concerns about deposit outflows; and a deterioration in or desire to improve their liquidity positions”…Given the importance of credit flow to the US economy we fear the optimism regarding a potential “soft landing” may be misplaced with the Fed potentially needing to reverse course and start cutting interest rates more aggressively than currently priced. We see upwards of 150bp of rate cuts in 2024 versus the market pricing of around 90bp.”That’s a wrap for today.Hope there will be better news to come later in the week.Have a good one.More By This Author:

Thoughts For Thursday: War Worries Rattle The Market

Thoughts For Thursday: Market Expectation – No Change In Fed Funds Rate