Image Source:

Image Source:

President-elect Trump has fired a salvo across the trade bow, announcing that he will levy a 25% tariff on Canadian exports to the US. In his first administration, threats of trade restrictions resulted in some relatively modest changes to NAFTA and, on balance, had no measurable impact on bilateral trade. The US ran a bilateral trade deficit each year since the first round of tariffs instituted by Trump. This time around he is wasting no time in calling for tariffs, but not in the form of a permanent tariff across the whole spectrum of goods flowing south.Rather, the tariffs are aimed at stopping an unwanted inflow of migrants and illegal drugs. He pledges to impose punitive tariffs “until such time” as Canada and Mexico put a stop to migration and drug traffic. Canada is a very tiny source of cross border migration, less than 20,000 yearly enter the US. Canadian and US border authorities have a long history of cooperation and this entire issue should not be blown out of proportion when discussing why tariffs are needed. At this point, nothing has been said regarding what Canada needs to accomplish to satisfy Trump’s conditions for lifting all tariffs.At first blush, a 25% tariff rate would seem to be a major blow to the Canadian economy. However, the involves many US-based companies, such as autos , with highly integrate supply chains across both the Canada-US and Mexico-US borders.. The disruptive nature of tariffs on intermediate inputs traversing the Canada-US would be highly inflationary in the US.

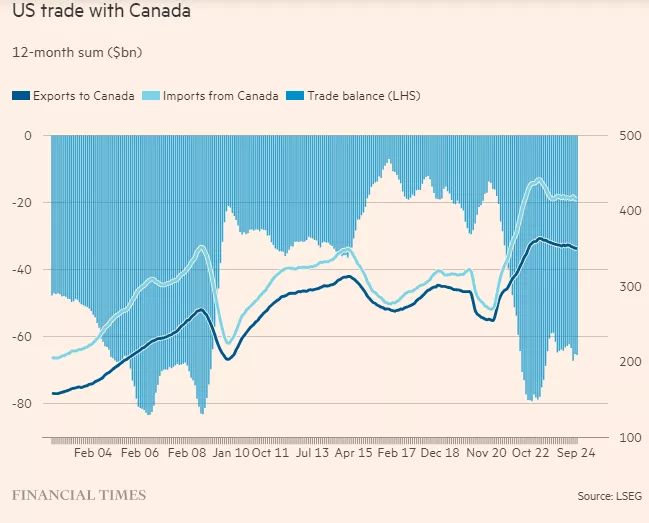

The US reliance on Canadian imports is often overlooked in the tariff debates (accompanying chart). As Canada’s deputy prime minister Chrystia Freeland stressed that Canada “buys more from the United States than China, Japan, France and the UK combined”, and last year supplied “60 per cent of US crude oil imports”. More than 20 US states have strong two-way trade flows with individual Canadian provinces. In other words, Canada is not without retaliatory measures should Trump declare an outright trade war.

Canada is the largest source of US energy imports. The US refineries rely upon 25%of its feedstock originating in western Canada. Without exemptions for Canadian crude oil, prices at the US pumps would dramatically increase. No president could politically withstand higher energy prices in search of tighter Canada-US border control. However, outside of the energy and auto sectors, there are several industries that have exposure to US tariffs, namely, a variety of mineral resources essential for US manufacturing.So, where does this threat leave Canada? At this moment, the tariff policies are vague and lack any specific implementation features. Brandishing this weapon is classic Trump-style behaviour. More is left unsaid than is said. Just how much of an impact tariffs affect Canadian access to the US market is far from clear. As the new US administration settles into office, their rhetoric will have to give way to a host of practical issues that drive the bilateral relationship. More By This Author: