Image Source:

Image Source:

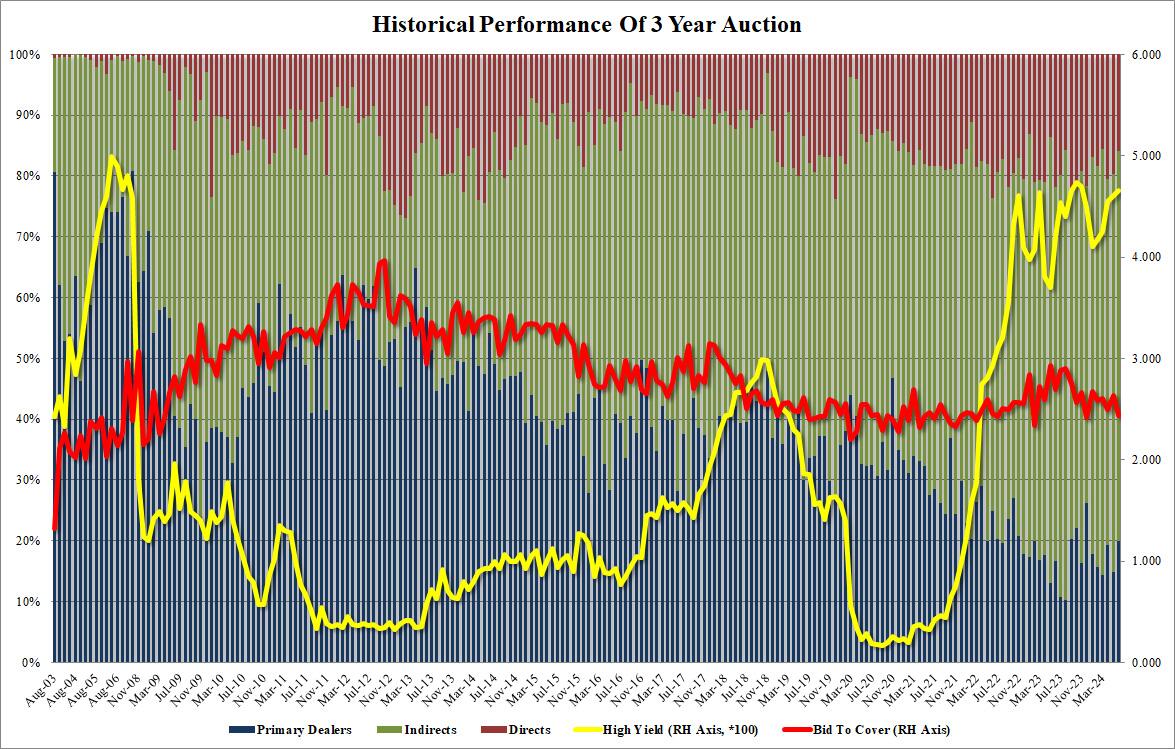

In a week where all attention will be on the CPI and Fed, clearly how bonds trade will be extremely important, so the reaction to today’s 3Y auction was closely watched. And it was not pretty.When the Treasury sold $58 billion in 3Y paper for sale, the market reaction was not pretty and for good reason: the demand sucked. Stopping at a high yield of 4.659%, up from 4.659% in May and the highest since November’s 4.701%, the auction tailed the When Issued 4.648% by 1.1bps, the first tail since April.The bid to cover slumped to 2.433 from 2.632, the lowest since December ’23, and well below the six-auction average of 2.567.The internals were mediocre at best, with Indirects awarded just 64.1%, the lowest since April but above the six-auction average of 63.2, which was dragged much lower due to the 52.1$ Indirects in the December auction. And with Dealers awarded 20.0%, the most since December, Directs were left holding 15.9%, the lowest since March.(Click on image to enlarge)

Overall, this was an ugly – if not horrendous – auction and the market reacted accordingly, sending yields to session highs and the 10Y rising as much as 4.48%.(Click on image to enlarge) More By This Author:

More By This Author:

Treasury Yields Jump To One-Week High After Ugly 3Y Auction