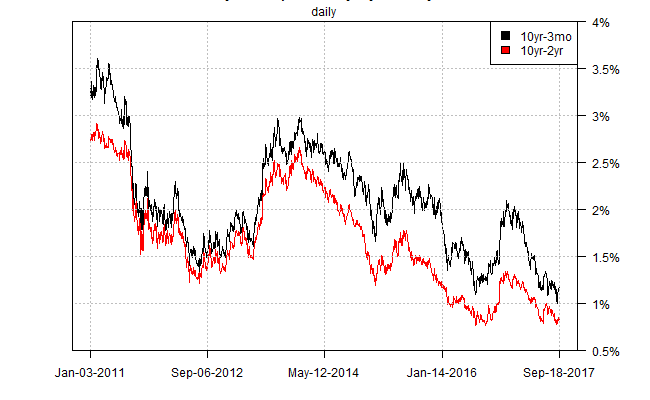

The Federal Reserve is expected to leave interest rates unchanged in tomorrow’s policy announcement, but the crowd is anticipating that the central bank will begin to pare its $4.5 trillion debt portfolio. If unwinding the balance sheet is about to begin, which implies tighter monetary policy, the first step in the process arrives as Treasury yield spreads are close to the lowest point since the last recession weighed on the US economy.

The difference in the 10-year Treasury yield less the 2-year rate, for instance, is less than 10 basis points above its lowest point in a decade, based on daily data via Treasury.gov. This spread ticked up to 83 basis points on Monday (Sep. 18), but that’s still close to the smallest difference since late-2007.

Low yield spreads are generally interpreted as a sign of caution for the economic outlook. By that reasoning, the sharp decline in spreads this year suggests that the Fed’s plans for trimming its balance sheet could create new headwinds for growth.

Even under the best of circumstances the road ahead for monetary policy may be hazardous as the central bank moves forward with reversing a decade of quantitative easing.

“Inching us out of this parallel universe of endless liquidity is going to be a fraught process,â€Â says James Athey, senior investment manager at Aberdeen Standard Investments. “No one’s done it before so no one can credibly claim to know what will happen.â€

The task may be further complicated if the bond market is pricing in a future of decelerating economic growth. For the moment, however, most forecasters still anticipate a moderate expansion for the near term. Wall Street economists are looking for third-quarter GDP growth of 2.4%, based on last week’s median forecast via CNBC’s survey for Sep. 16. Note, however, that the outlook calls for a moderately softer rise vs. Q2’s 3.0%. It’s unclear how much of the anticipated deceleration is due to the temporary blowback from recent hurricanes.