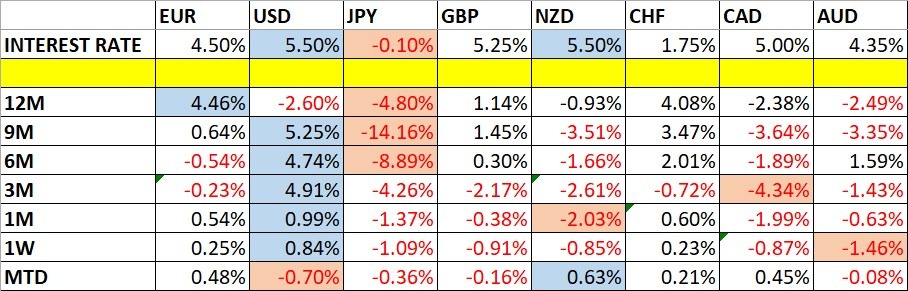

Let’s take a look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies. (Click on image to enlarge)

(Click on image to enlarge)

Monthly Forecast for November 2023

For the month of November, I made no forecast, as the US dollar was making a deep counter-trend retracement.

Weekly Forecast for Sunday, Nov. 12, 2023

, I forecasted that the NZD/USD and AUD/USD currency pairs would fall in value. This was a good call, as the NZD/USD currency pair fell by 1.81% and the AUD/USD currency pair fell by 2.37%, giving an average win of 2.09%.This week, I will not provide a forecast as there were no unusually strong counter-trend price movements in the Forex market throughout the past trading period.Directional volatility in the Forex market decreased last week, with 37% of the most important currency pairs fluctuating over the week by more than 1%. Volatility is likely to increase over the coming week, due mostly to the scheduled US CPI (inflation) data release. Last week was dominated by relative strength in the US dollar, and relative weakness was seen in the Australian dollar.

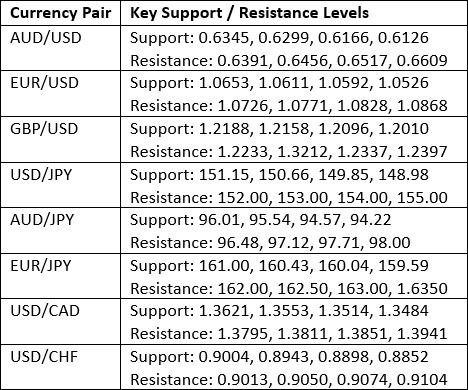

Key Support/Resistance Levels for Popular Pairs

I often teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that can be monitored on the more popular currency pairs this week. Let’s see how trading one of these key pairs last week off of key support and resistance levels could have worked out.

Let’s see how trading one of these key pairs last week off of key support and resistance levels could have worked out.

USD/CAD

I had expected the level at $1.3815 might act as resistance in the USD/CAD currency pair last week, as it had acted previously as both support and resistance. Note how these “role reversal” levels can work well.The H1 price chart below shows how the price rejected this level during last Friday’s New York/London session overlap (which can be a great time to enter trades in major currency pairs like this one) with a bearish pin bar, marked by the downward arrow, signaling the timing of this bearish rejection. This trade has been profitable so far, giving a maximum reward-to-risk ratio of more than 1 to 1 based upon the size of the entry candlestick. (Click on image to enlarge) More By This Author:GBP/USD Forex Signal: Forecast As Crude Oil Price DipsEUR/USD Forex Signal: Falling on Stronger DollarBTC/USD Forex Signal: Bitcoin Forecast As A Bullish Breakout Nears

(Click on image to enlarge) More By This Author:GBP/USD Forex Signal: Forecast As Crude Oil Price DipsEUR/USD Forex Signal: Falling on Stronger DollarBTC/USD Forex Signal: Bitcoin Forecast As A Bullish Breakout Nears