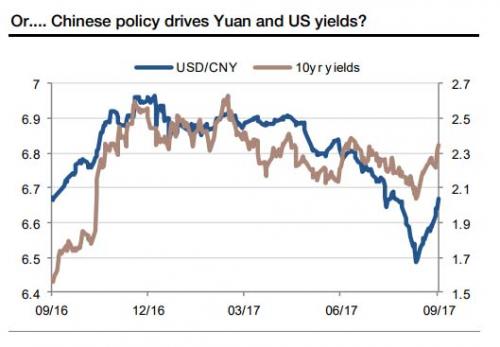

Having predicted yesterday that the rout in the Turkish Lira is only just starting, and will reverberate among – and sink – other emerging market currencies (so far the USD/TRY move has been largely ignored by virtually everyone), today Bloomberg macro strategist Mark Cudmore writes that while he remains bearish the dollar over the long-term, he suggests that the bounce in the dollar is far from over, citing the strong US economy, yield support and all time highs in the market. Of course, as SocGen conspiratorially suggested two weeks ago, the fate of the dollar may not be determined by the US at all, but is set by China. After all the USD bottomed on the day China unveiled its revised currency regime in which it invited speculators to short the Yuan…

In any case, here is Cudmore with his latest Macro View

The dollar bounce is unlikely to be over yet.

Investors have become so used to low volatility they are starting to over-interpret every little move in asset prices. The two latest examples are traders concluding there’s no contagion from Turkey’s problems just as they begin, and dollar bears heralding the resumption of the long-term downtrend when the Bloomberg Dollar Spot Index is only 0.6% from its 12-week high.

It’s not that they are incorrect. It’s that we don’t know yet and it’s far too soon to be declaring victory in either case.

Even to someone who regularly reiterated, in this column, the structural bearish case for the dollar since December 2016, this seems like a poor time to be confident in its decline.

U.S. data this month has been undeniably strong. Never mind that hurricanes have played a role in distorting the releases, it would be foolish to dismiss the broad picture of improvement we’re seeing.

Yield support is also looking more sustainable. The Fed’s desire to tighten has been made clear and suddenly we are seeing glimmers of inflation to back its hawkish stance. The ISM prices paid reading was the highest since 2011, while average hourly earnings saw the largest annual jump since 2009.

Unemployment was the lowest since 2001 even as participation jumped. The household employment survey is extremely volatile — but it’s less affected by hurricanes and still showed the highest print since 2013.

So, in summary, we have stocks at record highs, a super strong labor market, the clearest inflation signs in years and the dollar made a clean break with the nine-month downtrend.

This seems like a crazy time to play for dollar depreciation. And, by the way, emerging markets may not yet be safe from Turkey either.