One of the key themes that smart people like Citi’s Hans Lorenzen and Deutsche Bank’s Aleksandar Kocic have been keen on emphasizing lately is the extent to which the rising tide that’s lifted all post-crisis boats is about to recede.

Simply put (here comes to pun), the central bank “put†is about the fade away.

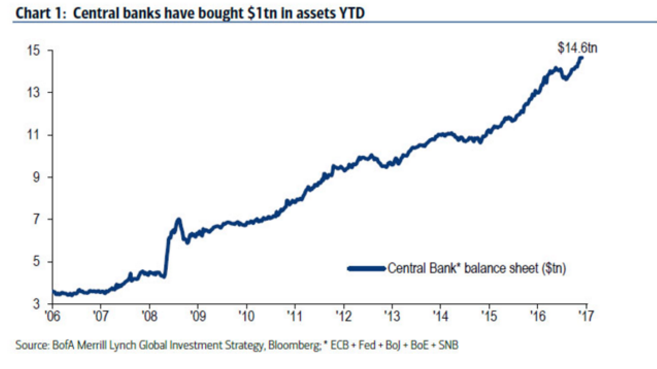

Yes, DM central bankers bought something on the order of $1 trillion in assets in Q1 and the SNB is nothing more than a giant, state-run hedge fund, but if things go according to plan, we’ve seen “peak central banks.â€

That being the case, investors would probably do well to consider that if they’re too late when it comes to understanding this they, like Wile E. Coyote, will run right off the cliff. And like Wile, that will be ok right up until they look down.

Well on Thursday, Bloomberg’s Richard Breslow is out with his latest and like Kocic and Lorenzen, he wonders if “traders who were late to the party in understanding that going along for the [central bank] ride was actually the best strategy, may be just as slow in realizing that the game is finally beginning to shift on them.â€

More below…

Via Bloomberg

Are you a chicken or an egg sort of investor? It matters in deciding whether fundamentals follow prices, or the other way around. The reality is that for most of us, price really is all that matters. We just don’t stick around long enough for grand narratives to play out. I think that’s why I preferred trading forwards rather than spot. But the opposite is true for long-term trending moves. It’s the narrative that must supersede in importance all the zigs and zags that characterize market behavior.