Top trades for 2016

It’s that time of the year again. Wall Street is busy coming up with its predictions for 2016, and Goldman Sachs is predicting more of the same for the next 13 months, a stronger dollar tighter sovereign credit spreads across Europe and an outperformance of large US banks.

Here are Goldman’s six top trades for 2016 in full.

See also:Â Goldman Makes 2016 Predictions, Targets Only 2100 on S&P, Says Fed More Hawkish Than Thought

Top trades for 2016 #1:Long USD vs. short EUR and JPY

Trade: Go long USD against an equally-weighted basket of EUR and JPY at 100, with a spot target of 110 and a stop loss of 95.

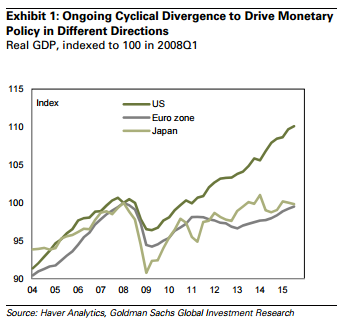

Thesis: According to Goldman, the divergence between the Fed and both the ECB and BoJ will continue on into 2016 as the ECB considers more easing and the Goldman Makes 2016 Predictions, Targets Only 2100 on S&P, Says Fed More Hawkish Than Thought. The economic recovery in Europe and Japan is struggling to gain traction while US growth is picking up, the labor market is improving, and domestic demand remains robust. Currencies are particularly sensitive to this divergence pressure, and Goldman believes the dollar has further upside.

Top trades for 2016 #1: Long USD vs. short EUR and JPY

Top trades for 2016 #2: Long US 10-year ‘Breakeven’ Inflation

Trade:Â Stay long 10-year US break-even inflation (USGGBE10 Index), opened on 10 November 2015 at 1.60%, with an initial target of 2.0%.

Thesis: The inflation swap market prices that headline CPI will not reach 2% until around 2020 and the option market assigns a 40% probability to CPI averaging less than 1% over the next five years. However, Goldman believes that the market is overlooking wage and price pressures, which could drive inflation expectations higher during the coming months as the drag from the energy complex falls away.

Top trades for 2016 #3: Long MXN and RUB versus short ZAR and CLP

Trade: Go long an equally-weighted basket of MXN and RUB versus short an equally weighted basket of ZAR and CLP, with an entry level of 100, total return target of 110 and stops at 95.