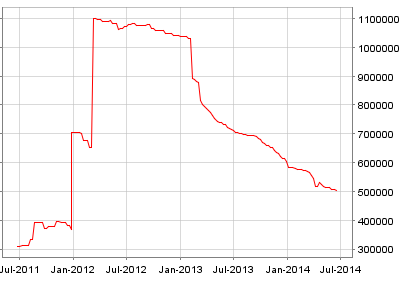

The Eurozone banks’ longer-term borrowings from the central banking system continue to decline, a trend that many economists view as a form of  “passive” tightening in the area’s monetary conditions.

Â

|

| LTRO balance outstanding (source: ECB) |

As discussed earlier (see post), the ECB will attempt to replace some €400bn of the lost balances with a new program dubbed TLTRO (“targeted” LTRO). Here is the official description:

The ECB: – Counterparties will be entitled to an initial TLTRO borrowing allowance (initial allowance) equal to 7% of the total amount of their loans to the euro area non-financial private sector, excluding loans to households for house purchase, outstanding on 30 April 2014. In two successive TLTROs to be conducted in September and December 2014, counterparties will be able to borrow an amount that cumulatively does not exceed this initial allowance.Â

During the period from March 2015 to June 2016, all counterparties will be able to borrow additional amounts in a series of TLTROs conducted quarterly. These additional amounts can cumulatively reach up to three times each counterparty’s net lending to the euro area non-financial private sector, excluding loans to households for house purchase, provided between 30 April 2014 and the respective allotment reference date in excess of a specified benchmark. The benchmark will be determined by taking into account each counterparty’s net lending to the euro area non-financial private sector, excluding loans to households for house purchase, recorded in the 12-month period up to 30 April 2014. All TLTROs will mature in September 2018.

The interest rate on the TLTROs will be fixed over the life of each operation at the rate on the Eurosystem’s main refinancing operations (MROs) prevailing at the time of take-up, plus a fixed spread of 10 basis points. Interest will be paid in arrears when the borrowing is repaid.Â

Starting 24 months after each TLTRO, counterparties will have the option to repay any part of the amounts they were allotted in that TLTRO at a six-monthly frequency.Â

Counterparties that have borrowed under the TLTROs and whose net lending to the euro area non-financial private sector, excluding loans to households for house purchase, in the period from 1 May 2014 to 30 April 2016 is below the benchmark will be required to pay back borrowings in September 2016.