Hotel/lodging REIT, Summit Hotel Properties, Inc. (NYSE:INN) is poised to start rapidly increasing its dividend rate. On that expectation, I have recently added Summit to our recommendations list.

Background

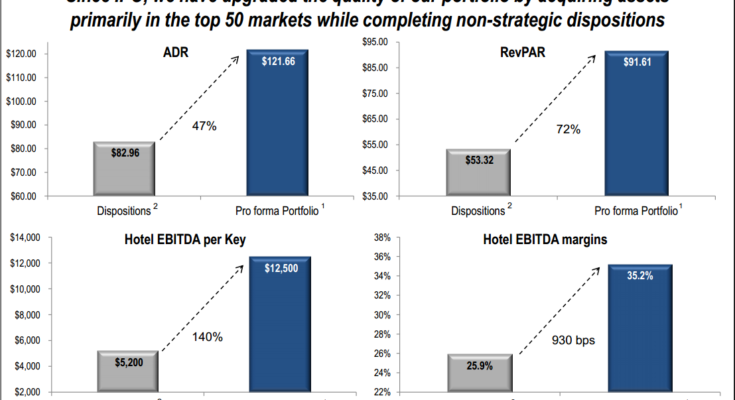

Summit Hotels launched with a February 2011 IPO. At that time the company owned about 60 hotels. Since the IPO, INN has purchased 49 additional hotels and sold 24. Currently the company owns 90 premium select-service hotels with top brands, in top markets. From an initial market cap of $364 million, INN has grown to $1.15 billion of market value. Management has strived to greatly improve the metrics by which hotel companies are measured as shown in this chart.

However, INN has yet to significantly increase its quarterly dividend rate. In August 2014 the INN dividend was increased by 4.4%, the first increase in the company’s history. Over the last year funds from operations, FFO, has grown by 44% and the FFO per share for the 2014 fourth quarter was more than double the quarterly dividend rate.

Other Lodging REIT Dividend Growth

Summit’s peers in the hotel/lodging REIT space are growing their dividends at very attractive rates. These REITs currently fill 5 of the top 7 spaces for year-over-year dividend growth on my REIT database. Here are the REITs and dividend growth rates:

- FelCor Lodging Trust Incorporated (NYSE:FCH): 100% growth, yield 1.5%.

- Host Hotels and Resorts Inc (NYSE:HST): 54% growth, yield 3.6%.

- Pebblebrook Hotel Trust (NYSE:PEB): 44% growth, yield 1.9%.

- RLJ Lodging Trust (NYSE:RLJ): 36% growth, yield 3.7%.

- LaSalle Hotel Properties (NYSE:LHO): 34% growth, yield 3.8%.

Economic conditions in the hotel industry are allowing these companies to steadily growth both room rates and occupancies. The sharper REITs are buying hotels and upgrading them through refurbishment and rebranding to improve profit margins.

I expect Summit Hotels to start growing its dividend at a 20% or better annual rate, starting with either the next or following dividend announcement. Any management discussion of dividend increases could send the share price higher. Current yield is 3.6%. As dividends grow, my target is 30%+ total annual returns.