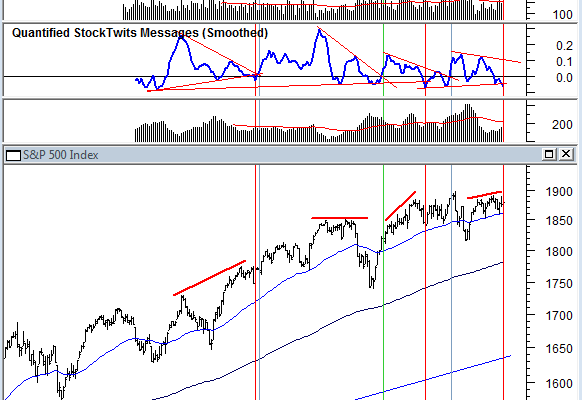

Over the next couple of weeks the market will be forced to choose a direction. The S&P 500 Index (SPX) is being squeezed between its 50 day moving average near 1860 and its last peak near 1900. Each day that goes by the 50 dma will move higher and put more pressure on the index. The pressure will force SPX to either move higher or fail at its 50 dma so we should get a direction over the next few weeks.

Coincidentally, support and resistance levels gleaned from the Twitter stream are compressing in  the same range. There are a few scattered tweets down near 1850, but the majority are near 1860.  Above the market the most tweeted level is near 1900. This the tight range suggests that traders are watching closely for a break before committing themselves.

Quantified messages from the StockTwits community issued a consolidation warning for SPX Friday at the close. Please note, this isn’t a prediction that the market will move lower, merely warning that sentiment and momentum from active market participants is falling which often results in choppiness.  The warning is triggered by a negative divergence between quantified messages and price that has been followed by a break below the confirming uptrend in the indicator. Basically, market participants are getting more cautious or shorting the market as it moves higher. Our indicator that quantifies the Twitter stream looks much the same but doesn’t have a confirming uptrend to give an official warning.  Here’s a bit more information about how we use the indicator for those of you who are interested.

Our core market health indicators are cautious enough to put our portfolio allocations at 70% long stocks we believe will out perform in an uptrend and 30% short the S&P 500 Index as a hedge.  However, the history of these indicators gives a 60% chance that this is normal rotation and profit taking that will result in higher prices when it’s done.  The bad news is that there is a 40% chance that the market is putting in an intermediate term top that will take prices below the 200 day moving average…and most likely down more than 10%.  So a break lower over the next few weeks should be significant.