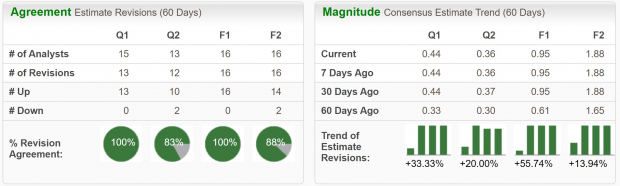

Image Source: Intel () has experienced a troublesome few years with the stock’s performance essentially flat over the last five years, and punctuated by considerable volatility. A mix of lackluster products against the backdrop of a rapidly advancing industry and compounded by general mismanagement has left Intel shareholders holding the bag.But with the release of its new Intel Core Ultra CPUs, the fate of this once-great American semiconductor manufacturer may have improved significantly.New TechIn late 2020, Apple () announced that it would shift away from using Intel-based chips in its computers, in favor of its new Apple Silicon-based M-series chips. This was a blow to Intel, but more importantly, marked a considerable shift in the PC chip market.Anybody who has used one of these new Apple computers knows just how great these new M-series products are, which really turned up the pressure on Intel to deliver something powerful. Although it took a few years, these new Core Ultra CPUs may play a major role in Intel reaffirming a dominant position.Intel’s latest Core Ultra processors mark a significant advancement in the semiconductor giant’s offerings. These processors, notably the flagship Core Ultra 9 185H, boast improved power efficiency and performance through a unique chipset setup. With 16 cores, including performance and efficient cores, and an NPU (neural processing unit) for AI acceleration, these chips signal Intel’s commitment to cutting-edge technology.Additionally, the introduction of NPUs demonstrates Intel’s strategic move towards AI integration, addressing contemporary computing demands. This innovation not only positions Intel as a frontrunner in the PC semiconductor industry but also aligns with the industry’s push for enhanced AI capabilities.Major laptop manufacturers like Lenovo, MSI, Acer, and Asus have swiftly adopted these chips, reinforcing Intel’s foothold in the market. As Intel continues to deliver cutting-edge solutions, this initiative solidifies its stance as a leading player in PC semiconductor technology, showcasing the company’s commitment to performance, efficiency, and AI-driven advancements.Earnings Trend Turning UpThis is just a week-old development, so it may be a few more weeks before analysts fully incorporate the news. However, even before this, earnings estimates began trending higher.Current quarter earnings have increased by 33% over the last two months, while FY23 estimates have been boosted by 56%. FY24 earnings have been raised by 14% and are projected to grow nearly 100% YoY to $1.88.Based on FY24 earnings estimates, INTC is trading at a forward earnings multiple of 24x, which is well below the industry average of 43x.

Image Source: Intel () has experienced a troublesome few years with the stock’s performance essentially flat over the last five years, and punctuated by considerable volatility. A mix of lackluster products against the backdrop of a rapidly advancing industry and compounded by general mismanagement has left Intel shareholders holding the bag.But with the release of its new Intel Core Ultra CPUs, the fate of this once-great American semiconductor manufacturer may have improved significantly.New TechIn late 2020, Apple () announced that it would shift away from using Intel-based chips in its computers, in favor of its new Apple Silicon-based M-series chips. This was a blow to Intel, but more importantly, marked a considerable shift in the PC chip market.Anybody who has used one of these new Apple computers knows just how great these new M-series products are, which really turned up the pressure on Intel to deliver something powerful. Although it took a few years, these new Core Ultra CPUs may play a major role in Intel reaffirming a dominant position.Intel’s latest Core Ultra processors mark a significant advancement in the semiconductor giant’s offerings. These processors, notably the flagship Core Ultra 9 185H, boast improved power efficiency and performance through a unique chipset setup. With 16 cores, including performance and efficient cores, and an NPU (neural processing unit) for AI acceleration, these chips signal Intel’s commitment to cutting-edge technology.Additionally, the introduction of NPUs demonstrates Intel’s strategic move towards AI integration, addressing contemporary computing demands. This innovation not only positions Intel as a frontrunner in the PC semiconductor industry but also aligns with the industry’s push for enhanced AI capabilities.Major laptop manufacturers like Lenovo, MSI, Acer, and Asus have swiftly adopted these chips, reinforcing Intel’s foothold in the market. As Intel continues to deliver cutting-edge solutions, this initiative solidifies its stance as a leading player in PC semiconductor technology, showcasing the company’s commitment to performance, efficiency, and AI-driven advancements.Earnings Trend Turning UpThis is just a week-old development, so it may be a few more weeks before analysts fully incorporate the news. However, even before this, earnings estimates began trending higher.Current quarter earnings have increased by 33% over the last two months, while FY23 estimates have been boosted by 56%. FY24 earnings have been raised by 14% and are projected to grow nearly 100% YoY to $1.88.Based on FY24 earnings estimates, INTC is trading at a forward earnings multiple of 24x, which is well below the industry average of 43x. Image Source: Zacks Investment ResearchChips for America ActBecause of the complicated nature of developing semiconductors, the rapidly shifting dynamics in the supply chain, and rising geopolitical tensions, securing the US’ semiconductor independence has become a major political focus.The CHIPS for America Act & FABS Act is set to bolstering U.S. leadership in semiconductors by allocating $52.7 billion for semiconductor research, development, manufacturing, and workforce development. This funding includes significant manufacturing incentives, R&D investments, and a 25 percent investment tax credit, aiming to secure domestic supply and create thousands of high-skilled jobs.Because Intel is part of the US semiconductor leadership, this is likely to provide considerable assistance to its growth as a company, as prioritizing semiconductor manufacturing has become such a priority.Bottom LineWhile the performance of Intel stock over the last several years has been unimpressive, it has rallied significantly off its recent lows, up 81% YTD. This is less than the broad industry, which has jumped significantly higher due to the developments in AI, but shows there is investor interest, nonetheless.I think based on the new chipsets, improving earnings estimates and political tailwinds this momentum should carry through to next year, and Intel should perform well going forward.More By This Author:2 Expansive Commerce Stocks To Buy At Year’s End Bull Of The Day: Emcor Group, Inc. Bear Of The Day: The Walt Disney Co.

Image Source: Zacks Investment ResearchChips for America ActBecause of the complicated nature of developing semiconductors, the rapidly shifting dynamics in the supply chain, and rising geopolitical tensions, securing the US’ semiconductor independence has become a major political focus.The CHIPS for America Act & FABS Act is set to bolstering U.S. leadership in semiconductors by allocating $52.7 billion for semiconductor research, development, manufacturing, and workforce development. This funding includes significant manufacturing incentives, R&D investments, and a 25 percent investment tax credit, aiming to secure domestic supply and create thousands of high-skilled jobs.Because Intel is part of the US semiconductor leadership, this is likely to provide considerable assistance to its growth as a company, as prioritizing semiconductor manufacturing has become such a priority.Bottom LineWhile the performance of Intel stock over the last several years has been unimpressive, it has rallied significantly off its recent lows, up 81% YTD. This is less than the broad industry, which has jumped significantly higher due to the developments in AI, but shows there is investor interest, nonetheless.I think based on the new chipsets, improving earnings estimates and political tailwinds this momentum should carry through to next year, and Intel should perform well going forward.More By This Author:2 Expansive Commerce Stocks To Buy At Year’s End Bull Of The Day: Emcor Group, Inc. Bear Of The Day: The Walt Disney Co.

This Semiconductor Stock Is Mounting An Epic Comeback With New Tech