Written by Dirk S. Leach

Today’s market is tough.

Bond yields were already at historic lows which pushed traditional utility stock valuations to historic highs.

Other income oriented equities like preferred shares and large REITs have also seen their share prices pushed up by lower for longer interest rates.

In today’s market, it is getting very difficult to find high quality conservative investments with a yield above 4% and even more difficult to find a monthly dividend paying investment above 4%.What is an income investor to do?

One answer is to look for smaller, well managed, fast growing companies that are focused on returning a healthy share of their earnings to their shareholders.This article highlights one such company, Whitestone REIT (WSR).

Readers of some of my earlier articles will note that I published on Sure Dividend a series of articles on monthly dividend paying REITs that started with “The Best Monthly Dividend Stocks“.I didn’t cover WSR in that article because this small cap retail REIT had been flying under my radar.Now that I’m aware of WSR, it is time to take a long hard look at this relative newcomer to the group.

When selecting a REIT for investment, it is important to look at the dividend yield through a qualitative (versus strictly quantitative) lens looking at the underlying risk adjusted performance to ensure the overall metrics such as the balance sheet, diversification, earnings growth, and payout ratios support continued growth of the REIT and its dividend.

Consistent with this approach, the investment thesis for WSR is presented in the following paragraphs and charts.

Whitestone REIT (WSR) In Focus

WSR is a fully integrated real estate investment trust that owns, operates and redevelops community centered properties. The company focuses on value creation in its community centers, concentrating on local service-oriented tenants.

Its diversified tenant base provides service offerings including medical, education, casual dining, and convenience services. The company was founded on August 20, 1998 as a non-publicly traded REIT headquartered in Houston, TX.WSR went public on August 25, 2010 and is approaching 6 years of successful operation as a publicly traded REIT.

As of the end of June 2016, WSR had a market capitalization of $420 million and owned 69 properties encompassing 5.9M square feet with an average annualized base rent (ABR) of $16.05 serving 1470 tenants.

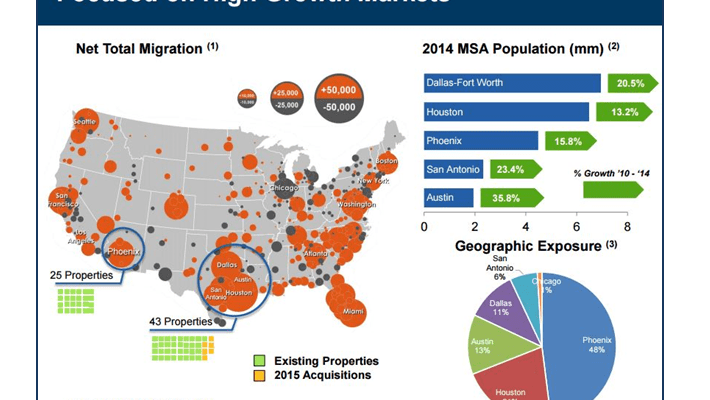

WSR maintains a strong shareholder focus with the intent to manage their properties in the best interest of the company and its shareholders.WSR has focused its growth in the fast growing sunbelt cities of Phoenix, Houston, Dallas-Fort Worth, Austin, and San Antonio.The figure below shows the population growth in the areas where WSR maintains its focus.

Source:Â WSR Website

Not only does WSR focus on fast growing regions, they also focus their investments towards fast growing communities and neighborhoods within those regions.

The charts below show the local growth and income metrics for the local areas and neighborhoods where WSR focuses its property investments compared to its peers.

Source:Â Â WSR Website

In addition to focusing on higher per capita locales with higher forecasted growth in household income, WSR is selective in the properties it acquires.The chart below summarizes the property acquisition and review process that WSR utilizes.

Source:Â Â WSR Website

The four charts above show, in summary, that WSR is targeting the sweet spots in the faster growing regions of the country and has a disciplined approach to property acquisition.