A month ago, we showed that the two most crowded trades in the hedge fund community going into 2015 are quite familiar: being long the USD, and short the 10 Year. Since then, the 10 Year has soared, having its best month in many years, and crushing those who were erroneously – for the 5th consecutive year – short bonds on hopes that this year, finally, the recovery will arrive (it didn’t) in the process leaving just the USD long (as represented by various pairs, most notably EURUSD shorts) as the most crowded trade of the year, which it will remain until the Fed finally cracks and admits that a strong dollar in a global recession, in which every other central bank is easing, is suicide for the US central bank.

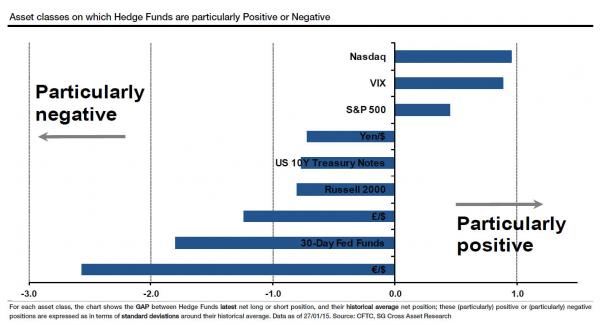

So what are the other “highest conviction trades” for the hedge fund community?

Here, courtesy of SocGen, is the answer, first for assets:

Â

And specifically for commodities:

Â

Some further commentary from SocGen:

- The market has pushed back on Fed guidance and the view of most Fed Watchers concerning the probability of a first rate hike in summer 2015, as evidenced by the huge shorts at the long end of the UST curve since summer 2014. Curiously, hedge funds remain somewhat net short on long dated bonds.

- Peak long dollar positions versus euro: The hawkish mood of the Fed supports net long dollar positions against all other currencies (€, £, ¥). Despite the sharp appreciation of the Swiss franc, induced by the sudden ‘de-peg’ by the SNB, positions are still net short the CHF.

- Treasuries: Being buyers of 30-year Treasuries for the better part of 2014, HF’s were correctly positioned for the drop in long term interest rates as well as for the ensuing yield curve flattening.

- Long oil, heavily short copper: Hedge Funds are still hugely long oil, whereas our commodity strategists anticipate that Brent will fall to $40. Meanwhile, the sharp drop in copper prices was correctly accompanied by historically strong net short positions (see chart below). We also note hedge funds’ renewed interest in gold with the strongest net long positions in over two years – this could prove to be a costly strategy when the Fed actually tightens.

- Long US equities but now short the Nikkei: Doubts about financial risks associated with huge BoJ injections (Japan CDSs are rising fast) has led hedge funds to turn net short on the Nikkei for the first time in two years (see our latest Asia Equity Compass). We switched to an underweight position on Japanese equities in December despite a continued bearish view on the yen. A return to net long VIX (yes, long equity volatility) rimes with hedge funds willing to hedge their ultra long positions on US equities.