Dividend investors are typically concerned with a stock’s current yield, dividend growth rate, or a combination of the two.

There are many companies that pay respectable and growing dividends and also offer shareholders high rates of earnings growth. This affords dividend investors the chance to not only collect income, but also to see strong total returns as a result of high rates of earnings growth.

This article examines nine stocks in our Sure Analysis Research Database that offer investors not only regular dividend payments, but also rates of growth of 12% or greater. Stocks are ranked in order of projected total returns, with #1 offering shareholders the highest projected total returns over the next five years.

Read on to see which high-growth stock offers the best-projected shareholder returns in the coming years.

High-Growth Dividend Stock #9: Boeing (BA)

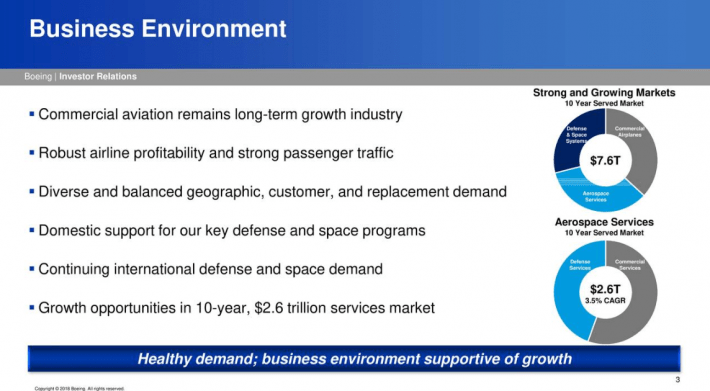

The Boeing Company is the world’s largest commercial jet manufacturer and second largest military weapons producer. The company has been in business since 1916. Boeing has a market cap of almost $200 billion and had more than $93 billion in sales in 2017. The company is composed of three divisions: Commercial Airplanes, Defense, Space & Security and Global Services.

Boeing is one of 747 dividend-paying stocks in the industrials sector.

Boeing reported 1st quarter 2018 earnings back in April. The company earned $3.64 per share in the quarter, easily beating expectations. Revenue grew 6.6% year-over-year to $23.4 billion, $1.18 billion above estimates. After a net booking of 221 orders in Q1, Boeing now has a backlog of ~5,800 airplanes which is worth $486 billion. Boeing delivered 184 commercial airplanes in the quarter, 9% more than the previous year. Boeing’s future growth is also virtually assured as it not only has the enormous backlog, but management forecasts that the commercial airline industry will need more than 40,000 new aircraft, which equates to almost $3 trillion dollars, over the next 20 years.

Source:Â Q1 Earnings Slides

Boeing updated investors during the Q1 earnings presentation on its long term fundamentals and growth opportunities, as seen above. The total addressable market continues to grow for each of Boeing’s major business lines and within that, Boeing is growing even more quickly. In short, long term fundamentals are very favorable at this point.

Boeing has seen its earnings-per-share increase at a rate of more than 12% since 2008. While earnings-per-share was cut by more than half during the last recession, Boeing quickly returned to growth in 2010 and has increased earnings every year since, with that growth accelerating of late. We are forecasting a continuation of that 12% growth rate looking forward given the backlog and long term tailwinds for Boeing as the world’s airlines continue to buy new aircraft.

Boeing has raised its dividend by at least 20% every year since 2013. Though impressive, this type of growth shouldn’t be expected to continue indefinitely. Dividend growth should at least mirror earnings growth going forward, producing a projected yield in excess of 3% in 2023.

Shares of Boeing are expected to return 6.0% per year over the next five years. This is a combination of 12% earnings growth, the current 1.9% yield and a 7.9% headwind from a lower valuation. While Boeing’s products are in high demand due to increases in air travel worldwide, that demand could weaken as economic conditions soften. That being said, Boeing is well positioned to capitalize on the growing demand for aircraft worldwide. The stock’s multiple is rich at these levels, but investors buying today can still decent growth through 2023.

High-Growth Dividend Stock #8: NVIDIA (NVDA)

NVIDIA Corporation is a specialized semiconductor company that designs and manufactures graphics processors, chipsets and related software products. Its products include processors that are specialized for gaming, design, AI data science and big data research, as well as chips designed for autonomous vehicles, robots, and more. NVIDIA was founded in 1993, produces $13B in annual revenue and is valued at $150 billion.

NVIDIA’s most recent quarterly results were strong as the company reported earnings per share of $2.05, an increase of 141% year-over-year. This immense earnings growth was accompanied by a revenue increase of 65%, to $3.2 billion. Guidance for Q2 sees revenues of $3.1 billion, a small decrease compared to Q1 results, but ahead of what analysts had expected.

Source:Â Investor Day presentation, page 51

NVDA produced record revenue, gross margin, operating income and earnings-per-share last year as a result of its significant growth drivers; this company is fully capitalizing on its exposure to several key markets like autonomous cars, cloud computing and gaming and the results have been extraordinary.

NVDA began paying its dividend in 2012 and growth has been rapid since that time. However, given the meteoric rise in the stock, the yield is currently just 0.2%. We see the dividend roughly doubling in the next five years but that should be good for a yield of just 0.6%, meaning NVDA isn’t and likely won’t be an income stock for a very long time to come, if ever.

NVIDIA has been a very successful player in the graphic processor (GPU) industry. Recently, NVIDIA’s growth exploded due to two main trends. First, cryptocurrencies have become more common, and miners who want to mine often do this with graphic processors. This has driven demand for top-tier GPUs over the last year, which is one of the reasons why NVIDIA was able to grow its GPU revenues by 77% during Q1. NVIDIA offers crypto-specific GPUs, but demand from miners is somewhat cyclical depending upon market prices for cryptos.

NVIDIA has also found out that its GPUs are very versatile in AI applications: This came as a surprise to NVIDIA as well, but the company has immediately started to capitalize on this trend by offering GPUs that are optimized for deep learning purposes, where these GPUs act as the brain of computers, robots, and self-driving cars. Those GPUs are utilized in professional visualization, data centers and automotive markets.

Even though NVIDIA has bought back shares occasionally, its share count has actually increased over the last five years. But given all of these factors, we’re forecasting 15% annual earnings-per-share growth for NVDA going forward, making it one of the fastest growing stocks in our coverage universe.

NVIDIA’s valuation has increased significantly since 2014. This was the point where NVIDIA transformed from a gaming-focused GPU producer into a company that sells its products to many different industries. The improved growth rates (and outlook with substantially bigger addressable markets) has led to a revaluation that has made NVIDIA’s shares rally. Its current valuation will likely not be sustainable in the long run, but due to its high growth rates and strong outlook NVIDIA will likely continue to trade at an above-average valuation for the foreseeable future. We see the current price-to-earnings multiple of 38.9 as unsustainable and forecast it to fall back to 25, implying a sizable 7.2% headwind to total returns as a result.

Overall, we are forecasting NVDA to produce 6%-7% total returns annually over the next five years, consisting of the 0.2% dividend yield, 15% earnings growth and an 8%-9% headwind from the valuation that we see as moving lower over time. NVDA would, therefore, be appropriate for those investors seeking high rates of growth, but wouldn’t appeal to those seeking a high yield or value, as NVDA offers neither.