Image: Shutterstock

Image: Shutterstock

Key Takeaways

We’re nearing the end of the 2024 Q3 cycle, which has brought many positive surprises — as it usually does. S&P 500 earnings are forecasted to be positive yet again, continuing we’ve enjoyed over recent periods.Several companies, including Tesla ( – ), Micron ( – ), and Arista Networks ( – ), all posted results that caused shares to see bullish movement post-earnings. Let’s take a closer look at each quarterly release.

Tesla’s Profitability Recovers

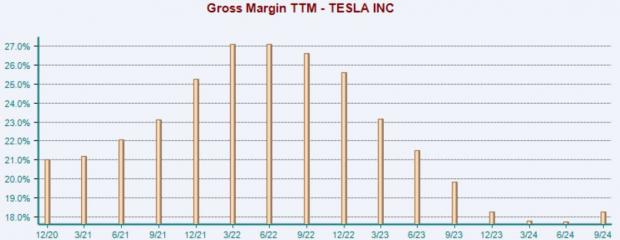

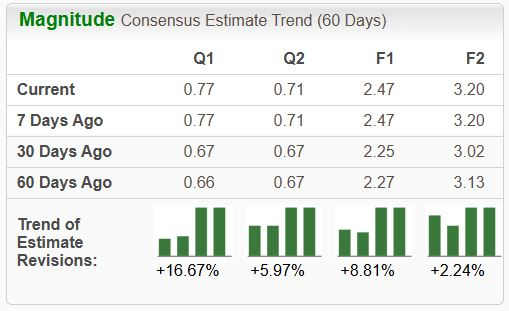

The critical metric for Tesla that has commonly dictated price swings is its EV production/delivery numbers, but margins have become the clear focus as of late. Concerning EV production/deliveries, Tesla delivered roughly 463,000 EVs and produced nearly 470,000 throughout the period.While the EV numbers are important, the real highlight of the release was margin expansion, with the company’s gross margin expanding nicely to 19.8% vs. a 17.9% print in the same period last year. As shown below, margins have finally begun recovering.Please note that the chart’s values are calculated on a trailing twelve-month basis. Image Source: Zacks Investment ResearchWhile margins remain well below the highs set in 2022, the recent uptick is undoubtedly encouraging, further underpinned by the fact that Tesla reported its lowest-ever level of cost of goods sold (COGS) per vehicle throughout the period.The favorable commentary surrounding profitability and results vaulted the stock into the highly-coveted Zacks Rank #1 (Strong Buy), with analysts revising their EPS expectations across the board following the release.

Image Source: Zacks Investment ResearchWhile margins remain well below the highs set in 2022, the recent uptick is undoubtedly encouraging, further underpinned by the fact that Tesla reported its lowest-ever level of cost of goods sold (COGS) per vehicle throughout the period.The favorable commentary surrounding profitability and results vaulted the stock into the highly-coveted Zacks Rank #1 (Strong Buy), with analysts revising their EPS expectations across the board following the release. Image Source: Zacks Investment ResearchOverall, the stock’s current momentum is undeniable, partly boosted by the recent U.S. election. But it remains the prime selection for those seeking EV exposure, and its present favorable Zacks Rank alludes to further near-term gains.

Image Source: Zacks Investment ResearchOverall, the stock’s current momentum is undeniable, partly boosted by the recent U.S. election. But it remains the prime selection for those seeking EV exposure, and its present favorable Zacks Rank alludes to further near-term gains.

Micron Benefits from AI

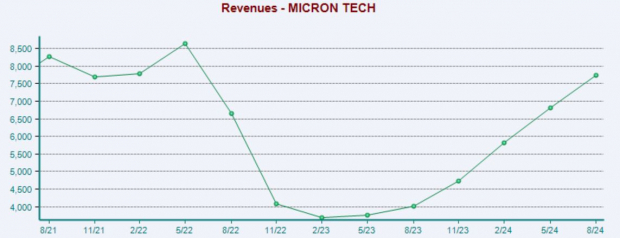

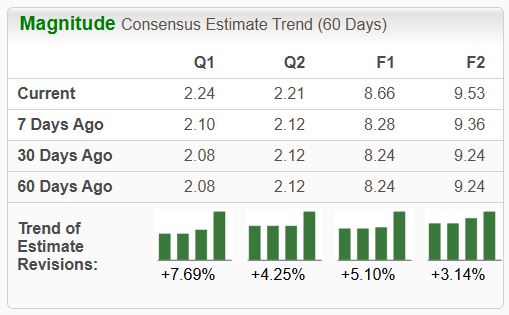

Micron helped set the tone for technology stocks overall in Q3 in its release in late September, with the company enjoying a massive 181% spike in EPS on 93% higher sales. The growth here is massive, underpinned by robust demand for the company’s data center products.The results overall confirm once again that the AI frenzy is here to stay, with Micron also forecasting record profitability for its next quarterly print. The company’s top line has recovered in a big way over recent quarters, as shown below. Image Source: Zacks Investment ResearchThe stock has seemingly given up the bulk of its post-earnings gains amid broader semiconductor weakness as of late, but the story overall remains positive. The valuation picture isn’t overly stretched, with the recent 2.8X forward 12-month price-to-sales ratio beneath the 2.9X five-year median and five-year highs of 4.9X.

Image Source: Zacks Investment ResearchThe stock has seemingly given up the bulk of its post-earnings gains amid broader semiconductor weakness as of late, but the story overall remains positive. The valuation picture isn’t overly stretched, with the recent 2.8X forward 12-month price-to-sales ratio beneath the 2.9X five-year median and five-year highs of 4.9X. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

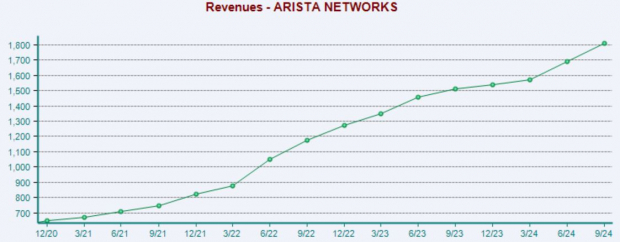

Arista Sales Continue Growing

Arista Networks has also been caught up in the AI frenzy, as the company is an industry leader in data-driven, client-to-cloud networking for large data centers, campus, and routing environments. The stock sports a favorable Zacks Rank #2 (Buy) rating, with its earnings outlook brightening following its latest release. Image Source: Zacks Investment ResearchJayshree Ullal, CEO, on the results:

Image Source: Zacks Investment ResearchJayshree Ullal, CEO, on the results:

Arista remains at the forefront of next generation centers of data across client-to-cloud and AI focused locations.

The growing AI landscape has benefited the company’s top line in a big way, with the company posting sequential revenue growth in each of its last ten periods. Below is a chart illustrating the company’s sales on a quarterly basis. Image Source: Zacks Investment ResearchLike Micron, shares have recently given up the bulk of post-earnings gains, perhaps a reflection of profit-taking after a massive run year-to-date.

Image Source: Zacks Investment ResearchLike Micron, shares have recently given up the bulk of post-earnings gains, perhaps a reflection of profit-taking after a massive run year-to-date.

Bottom Line

The 2024 Q3 earnings cycle is nearing its end, with just a handful of S&P 500 companies yet to report quarterly results.And throughout the period, several companies, including Tesla ( – ), Micron ( – ), and Arista Networks ( – ), all posted results that pleased investors.More By This Author:2 Companies Unlocking Higher Profits: AMD, TSLAIs This Home Improvement Giant A Buy Before Earnings? 3 Stocks Seeing Insider Buys: CNC, PFE, BMY