<< Read The Warren Buffett Economy—-Why Its Days Are Numbered, Part 1

<< Read The Warren Buffett Economy—Why Its Days Are Numbered, Part 2

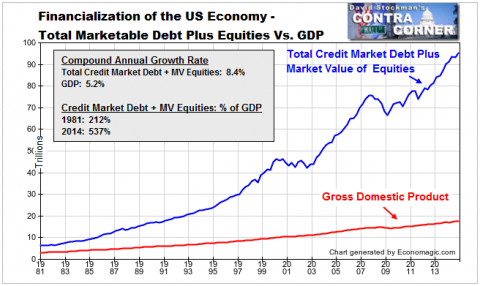

During the last 27 years the financial system has ballooned dramatically while the US economy has slowed to a crawl—–a divergent trend that has intensified with the passage of time. For instance, since the Q4 2000, nominal GDP has expanded by just 70% compared to a 140% gain in market finance (i.e. the value of non-financial corporate equity plus credit market debt per the Fed’s Flow Of Funds report).

As a consequence, and as we previously demonstrated, the ratio of finance to economic output has soared to nearly 540% of national income compared to a historic norm of about 200%. Had even the stabilized ratio of 240% that the Volcker sound money policy had put in place by 1986, for example, remained at the level, total market debt and equity finance would be $50 trillion lower than today’s gargantuan $93 trillion total.

Â

Total Marketable Securities and GDP – Click to enlarge

Even when you purge the cumulative price inflation out of the above picture, the story does not remotely add-up. That is, while real median household income has not gained at all since the late 1980s, and thus currently stands at just 1.03X of its 1987 value, the GDP deflator-adjusted value of corporate equities and credit market debt outstanding stands at 8.0X and Warren Buffett’s real net worth at 19.0X.

Needless to say, that’s not capitalism at work; its central bank driven bubble finance. So the question remains why did the Fed expand its balance sheet by 22X over the past 27 years (from $200 billion to $4.5 trillion)? After all, the empirical result was a sharp slowing of main street growth, a massive financialization of the US economy and monumental windfalls to financial speculators who surfed on the $50 trillion bubble.

And let’s first sharpen the financial surfer point. Warren Buffett is not a genius and did not invent anything, even a unique method of investing and allocating capital. He may have read Dodd and Graham as a youthful investor, but his nominal net worth did not grow from $3.4 billion in 1987 to $73 billion at present by following the old fashioned precepts of value investing.

Instead, he bought the obvious consumer names of the baby boom demographic wave like Coke and Gillette; had a keen ear for buying what he believed slower footed investors would also be buying later; appreciated the value of banks and other companies that suckled on the public teat; and mainly rode the 27-year wave that caused finance to soar from $12 trillion to $93 trillion after Greenspan took the helm at the Fed.