London’s economy may be decoupling from the rest of the U.K. at an accelerating pace. As Bloomberg’s Niraj Shah explains, the capital’s contribution to U.K. output, house prices and financial jobs are all at a record high while the suicide rate is at a series low… while the rest of the nation is ‘not’.

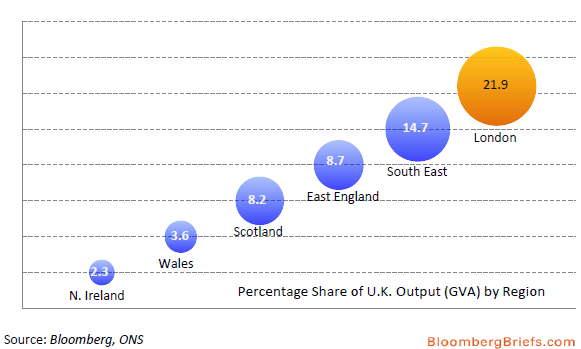

London Contribution to U.K. GDP at Record High

London’s GDP is larger than that of 12 of the 18 euro-area nations. London’s share of U.K. output measured by gross value added rose to a historic high of 21.9 percent in 2011, the latest available data from the ONS show. Scotland accounts for 8.2 percent of U.K. output. One in 28 Londoners is a millionaire, according to wealth analysts Wealth Insight.

Financial Sector’s Growing Dominance

The number of financial services jobs in London rose above the pre-crisis level last year to 688,000, according to lobby group TheCityUK. City jobs are forecast to rise by 2.7 percent this year to 707,500. The financial sector accounted for 21.1 percent of London’s output in 2010. Sixty percent of inner London workers are graduates, compared with 29 percent in northeast England, the ONS says

Record House Prices

The gap between London house prices and those in the rest of the U.K is widening. Values in London rose 12.3 percent in the 12 months through December, compared with 3.1 percent when the capital and southeast England are excluded. The average London house price was 450,000 pounds in December, compared with the national average of 250,000 pounds, the ONS says. That is 28.6 percent above the pre-crisis peak.

Suicide Rate Drops to Series Low

The suicide rate in London fell to a series-low of 8.7 deaths per 100,000 in 2012 from 8.9 per thousand in 2011. That compares with 12.4 deaths per 100,000 in the northwest. The number of London suicides fell to 576 in 2012 from 985 in 1981. In 25 years, the capital’s suicide rate has dropped to the lowest in the U.K. from the highest.