The S&P 500 Index is up just 1.6% year-to-date, through 5/18/18. When the market goes sideways, or worse yet—declines—stocks that pay dividends become even more valuable. Receiving quarterly dividend income helps boost returns, regardless of the direction of the broader stock market.

All stocks in the Sure Analysis Research Database pay dividends, but only a select few have high dividend yields above 5%.

While high dividend yields are at times associated with a deteriorating business, there are some high-yielding stocks with strong brands and more than enough cash flow to sustain their dividends.

The following list encompasses a wide range of market sectors, such as telecom, consumer staples, and healthcare. It excludes REITs and MLPs, which are in the Sure Analysis Research database, but are separate asset classes, with unique risks and tax implications.

This article will discuss the top 5 stocks with 5%+ yields that we cover in the Sure Analysis Research database.

No. 5: Verizon Communications (VZ)

Dividend Yield: 5.0%

Verizon provides telecommunication services including cable, broadband, and wireless phone. Business conditions have become more challenged for Verizon over the past year. Wireless competition has intensified from lower-priced carriers such as T-Mobile (TMUS). Fortunately, incentives designed to retain customers—such as offering unlimited data—have worked well.

On 4/24/18, Verizon reported strong first-quarter earnings that beat on both the top and bottom lines. Revenue of $31.77 billion rose 6.6% from the same quarter a year ago, and beat expectations by $550 million. Earnings-per-share of $1.17 beat estimates by $0.06 per share.

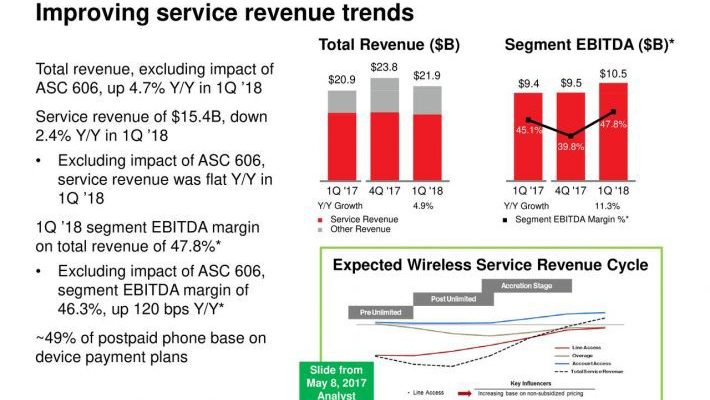

Source:Â Earnings Presentation, page 8

Verizon Wireless revenue increased 4.9% last quarter, which more than offset a 1.6% decline in wireline revenue. Postpaid smartphone net adds were 220,000 for the quarter. For 2018, Verizon expects full-year revenue growth in the low-single digits. Adjusted earnings-per-share growth is expected to grow at a similar rate as revenue.

Verizon has positive long-term growth potential, because it has among the strongest networks in the wireless industry. The company spent $17.2 billion on capital investments in 2017 alone. New technologies will help Verizon retain its competitive advantages. Two emerging technologies that will fuel Verizon’s growth are 5G deployment and the Internet of Things.

According to Verizon’s 2017 annual report, 5G “will allow 10 to 100 times better throughput, 10 times longer battery life and 1,000 times larger data volumes than anything offered todayâ€.

Source: Analyst Meeting Presentation, page 14

Verizon estimates the total market opportunity for 5G at $12.3 trillion, by 2035. Another catalyst from 5G deployment is that it will further enable Verizon’s Internet of Things, or IoT business. Verizon expects the number of IoT connections to increase to over 20 billion by 2020. Verizon’s IoT revenue increased over 10%+ in 2017, and rose by another 13% last quarter.

Verizon stock has a price-to-earnings ratio of 12. Over the past 10 years, the stock held an average price-to-earnings ratio of 14, which we believe is a reasonable estimate of fair value. As a result, a rising price-to-earnings ratio could add 3% per year to annual returns. Verizon’s high dividend yield will add to shareholder returns. Verizon had a 62% payout ratio in 2017, which indicates the dividend is secure.

To help further enhance its dividend coverage, Verizon is planning a massive cost-cutting program. The company is targeting $10 billion in cost reductions through 2021. The savings will be taken from operating and capital expenditures, as the company implements zero-based budgeting. It can use the cost savings to fund its dividend and pay down debt.