Dividend Kings tend to be large, well-established blue-chip businesses. Companies like Johnson & Johnson (JNJ), Coca-Cola (KO), and 3M (MMM) come to mind.

It makes sense that the typical Dividend King is a large cap stock; after all, increasing dividend payments for 50 consecutive years is a feat that shows prolonged growth.Prolonged growth leads to larger businesses.

Only 18 publicly traded stocks have managed to increase their dividends for 50 or more consecutive years.

There is one Dividend King with a market cap of under $500 million. This company is Farmers & Merchants Bancorp (FMCB) [referred to hereafter as F&M Bank].

Not only is F&M Bank (FMBM) the smallest Dividend King, it is also one of the newest.The company reached 50 consecutive years of dividend increases in 2015.

This article explores the investment prospects of F&M Bank, the smallest Dividend King.

Company Overview

F&M Bank was founded in 1916 in California.As of its most recent quarter, this regional bank has $2.691 billion in assets on its balance sheet.

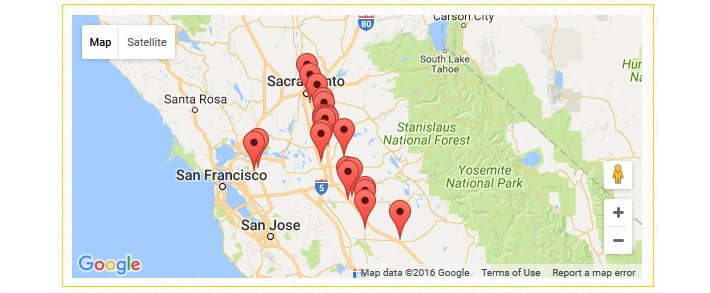

Over the last 100 years, F&M Bank has slowly expanded from 1 location in California to 24.The image below shows the company’s locations (all of which are in California).

Source:Â Â F&M Bank

F&M Bank has historically grown very slowly, but that may be changing soon…

Growth Prospects

F&M Bank has historically not appeared to be particularly interested in growth.The company’s shares are thinly traded and closely held.

The company appears to have found a renewed resolve to grow, however.

F&M Bank had not made an acquisition since 1985, until recently.According to this article which discusses F&M Bank CEO Kent Steinwert’s plans, the company is:

“Now planning to grow through more acquisitions and new branch openings.â€

On June 8th, F&M Bank announced it will acquire Delta National Bancorp for around $6.6 million.The move will add 4 new bank locations to F&M Bank – which is 17% growth in its location count.All locations are still in the state of California.