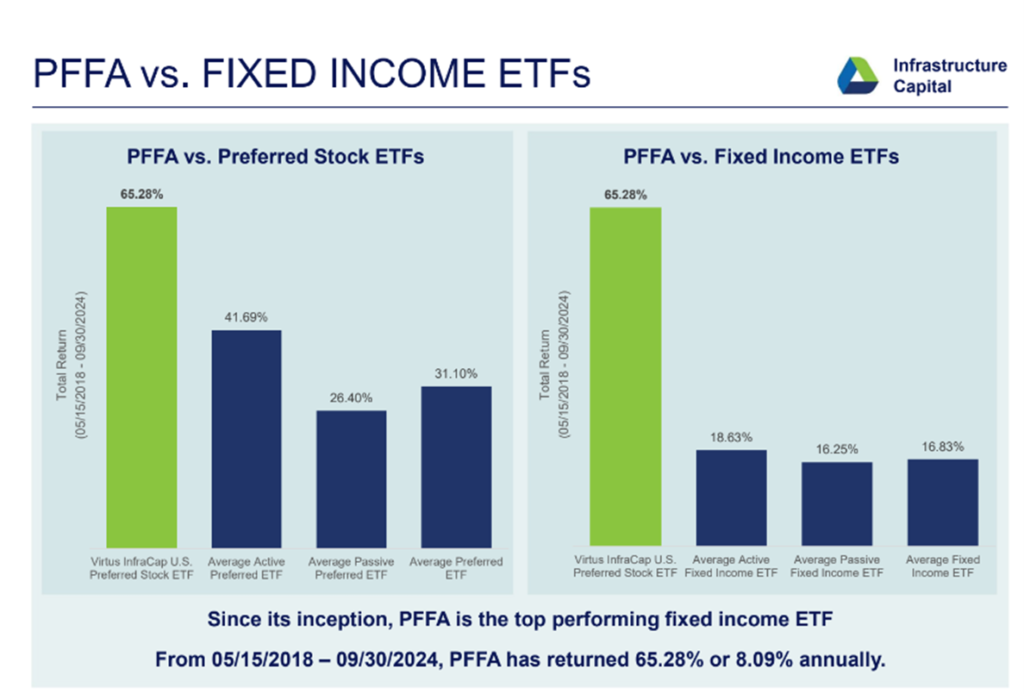

I don’t look at fixed income based exclusively on Wall Street expectations. The news media and large investment firms like to play the interest rate game, investing based on where they think interest rates will go. I prefer using fixed-income investments to generate stable, high-yield cash income streams.Recently, one of my favorite income ETFs sent out a fascinating graphic. Let’s get right to it. The Virtus InfraCap U.S. Preferred Stock ETF () is actively managed. The chart results speak for themselves. I added PFFA to my Dividend Hunter-recommended portfolio in November 2018. I am in regular contact with the fund managers. Let’s go over a few highlights about the ETF.

The Virtus InfraCap U.S. Preferred Stock ETF () is actively managed. The chart results speak for themselves. I added PFFA to my Dividend Hunter-recommended portfolio in November 2018. I am in regular contact with the fund managers. Let’s go over a few highlights about the ETF.

The PFFA current yield is 8.9%, close to the 8.09% average annual return highlighted above. Investors can count on the PFFA yield for income and expect their principal value to be stable (over the long run).PFFA is an excellent representation of the types of investments in my Dividend Hunter service. The newsletter helps investors focus on building a stable, high-yield income stream. If you do that with a suitable high-yield investment, your principal value will take care of itself.More By This Author:How to Earn Up to 200% Yields With These Market-Proof ETFsBitcoin’s March To $100,000: Can You Profit Without Trading Crypto? SFL: Unlock A 10% Yield In Shipping’s Toughest Market Yet