FOMC Debate on Rate Hikes

There is a lot of debate about what the Fed is going to say regarding rates next Wednesday at the FOMC Meeting, will they change the language, will they signal rate hikes, etc. but pundits haven`t really addressed the main reason the Fed has to raise rates in June.

Consider the Alternative

The real reason is to consider the alternative, that they wait and raise rates at the next major quarterly Fed Meeting in September. If we assume the same continuation trends regarding employment, GDP, retail spending etc. that we have been producing for the last 12 months then things are going to get real uncomfortable for the Fed and markets come the September FOMC Meeting. For example, the unemployment rate may be close to 5.2% or lower in September, wage inflation and the core inflation readings have been ticking higher, which will only escalate if the current economic trends of small business and consumer optimism continue their current pace, and the gasoline stimulus starts pushing through for consumers from their bank accounts out into the broader discretionary spending landscape.

When Everyone including Financial Markets Realize that the Fed is behind the curve

This could cause the Fed and the markets to realize in retrospect that they are well behind the curve, and the dreaded 50 basis point rate hike comes in September, followed by another 50 basis point rate hike the following month. The turmoil in markets would be considerable to say the least and cause a severe asset reallocation in markets all at once. Those of you who wish for a delayed rate hike, only like that alternative if the Fed never raises rates, which is highly unlikely given the performance of the economy and its current pace of trending growth.

The Trade-off

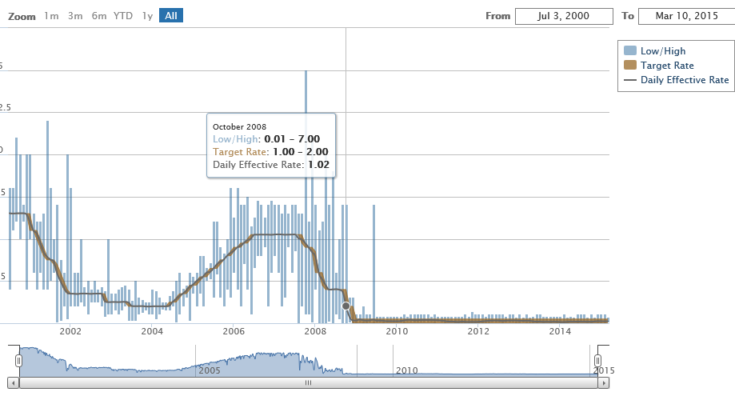

Therefore if rates are going up even the most dovish market participants want the Fed to raise in June by 25 basis points, and slowly ease into the rate hiking cycle. Sure there will be some market turmoil, but market turmoil is inevitable given ZIRP for 7 years, there is no getting around this, and the Fed knows this fact. What these same dovish participants don`t want is a 50 basis point rate hike in September because the Fed waited way too long when it was obvious they should start raising rates in June. The Fed themselves doesn`t want to cause this kind of market volatility. The tradeoff is a no brainer, take a little pain now for markets, or a whole bunch of pain by waiting until September. The September option risks the possibility that everyone knows it is too late to raise rates by slowly getting into the rate hiking cycle with a measly 25 basis point rate hike, that isn`t going to cut it in September with a 5% unemployment reading and a 25 basis point Fed Funds Rate. History and economic theory has proven this is disastrous to say the least.