The problem in EU is too much debt, particularly too much bad debt. Under the circumstances anything the ECB does to stimulate credit is pushing on a string. It won’t stimulate loan demand when the only way to get healthy for most players in Europe is to reduce the overhang of bad debt.

The deleveraging in Europe is healthy and will continue. The banks will take the Euros received in these asset sales to the ECB and will continue paying down their other ECB loans and will continue extinguishing debt and money. The ECBs balance sheet will grow little if at all.

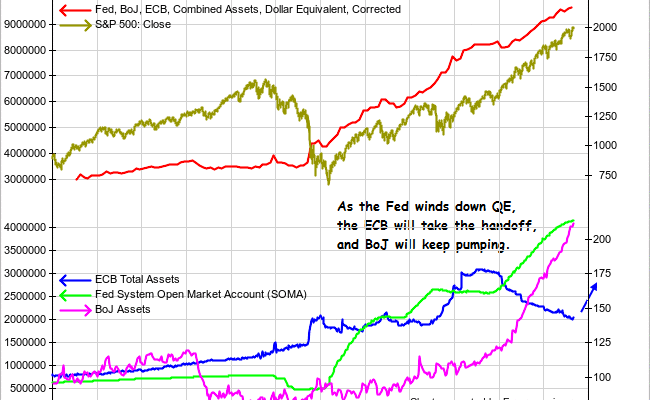

But the asset purchases will liquify bank trading portfolios and some of that cash will find its way where it always does, to the last Ponzi Game Standing, the US stock market. There are three main pumpstations into just one worldwide liquidity pool. It does not matter who is doing the pumping. The same players are playing in the pool and they’ll continue to play the same games they have played for the past 5 1/2 years.

The newly announced program is just another silly Super Mario game. Meanwhile, read more on this here.Â