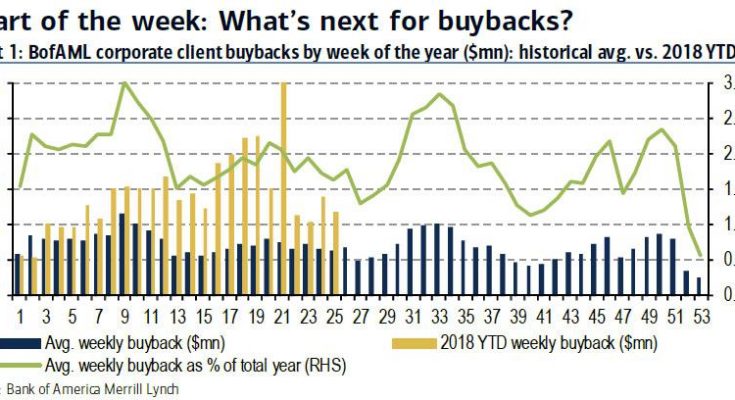

It is well known that stock buybacks have been among the primary contributors for the solid stock performance in the US in 2018. This was largely thanks to Trump’s tax reform which allowed companies to use repatriated cash to repurchase stock. The following “chart of the week” from Bank of America, one week ago, shows just how pervasive the buyback wave had been so far in 2018, as the bank’s clients deployed record amounts of cash to repurchase their own stock.

One week later, BofA’s Client Flow monitor provides an update and finds that ahead of the earnings season blackout, buybacks by corporate clients have slowed down modestly to a six-month – in line with seasonal patterns – but YTD still remain +101% YoY and continue to suggest a record year for buybacks.

But while corporate buybacks may be fading into earnings, it is total buyback activity throughout the first half of 2018 that reveals a surprising picture. As shown in the most recent “Chart of the week” from BofA, which lays out first half sector flows, corporate clients’ buybacks were the largest buyers within Financials ($10.6bn), Tech ($10.5bn), Health Care ($6.5bn), Consumer Discretionary, and Industrials.

In fact, in a dramatic display of just who has been buying tech stocks, BofA (BAC) reveals that “net buying of Tech in the 1H was entirely buyback-driven.”

So much for speculation that hedge funds and institutions have been chasing after tech performance: it was just tech companies – at least the subset which operates via Bank of America’s buyback desk – repurchasing their own stock. And not just tech companies but financials, industrials and discretionary. Meanwhile, single stocks have been uniformly sold across all sectors with the sole exception of industrials, which is the one sector with 1H flows into single stocks by both corporate and non-corporate clients along with sector ETFs.

So if BofA’s corporate clients were the overwhelming buyers of stock in the first half, that would mean that all other clients were selling. And sure enough, as BofA writes, while private clients – or ultra high net worth individuals- were the sole net buyers of US equities in a token amount (in addition to corporates) in the 1H, institutional clients were the biggest sellers, while hedge funds were also net sellers for the duration of the quarter.