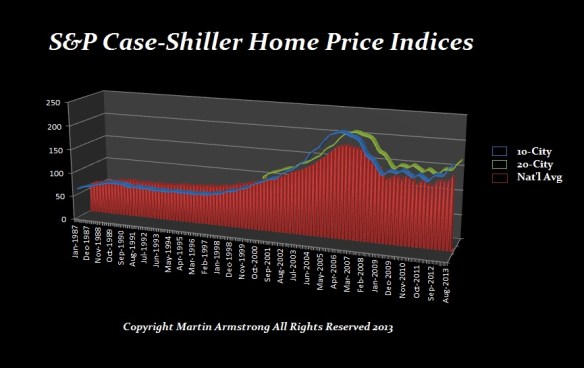

With the Economic Confidence Model peak in 2007.15 (February 26th, 2007), that turning point marked the very day of the high in the Case-Shiller Real Estate Index. However, it also market the precise day of the infamous sale at the top of Goldman Sachs’ notorious ABACUS 2007-AC1 $2 billion Synthetic CDO. Indeed, Goldman Sachs was later charged with fraud by the SEC (SEC-Complaint-Goldman) precisely on the Pi target from the peak in the ECM. Many people assumed that Goldman Sachs was using our ECM to time to the day when to sell the whole Real Estate bubble. I cannot confirm or deny anything. I certainly did not advise Goldman. If they timed the offering with the ECM, what can I really say. That date was published back in 1985.

Indeed, even the Senate had hearings calling Goldman Sachs to testify. Here are their short notes of the overview of the deal (Senate-Overview-Goldman). Of course, nothing took place other than a SEC civil complaint. (ABACUS-Offer-Document Goldman Sachs)

February of 2007 was the peak of the US Real Estate Bubble. Even the Wilshire US Real Estate Investment Trust (REIT) Total Market Index set a record high of 6,501.40 at the time. Taking this index and creating a ratio to GDP show that the Wilshire US REIT/GDP Ratio stood at 45.7% in 2007 and crashed to 13.32% by 2009. Interesting, however, the Wilshire US REIT Total Market Index made new highs inf 2013. However, the economy has not recovered in the same manner and this ration only reached 39.9%.

We reported in April 2014 that the high-end real estate was still rising. There was clearly a shift in the marked that we warned should unfold. The low-end of the market where the CDOs were focused, would not recover to new highs. We warned that new highs would be seen in many areas both East and West in the USA as a capital flight both from banks and Europe/Asia.

Last week, the Wilshire US REIT/GDP Ratio reached a new all time high of 46%. This does not mean that the Fed has re-inflated real estate. In fact, that is not even close to what is happening. Real Estate is a highly diverse market that defies a single forecast. It requires splitting both into regions and then sectors within those regions.