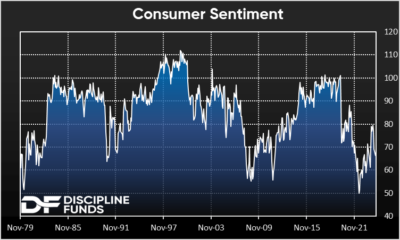

Image Source: One of the big puzzles of the last few years has been consumer sentiment. The US economy and stock market have outperformed virtually every global economy and market. Wages have grown nicely in the last few years. And yet sentiment remains subdued. What gives?

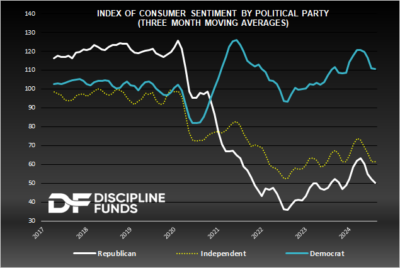

Image Source: One of the big puzzles of the last few years has been consumer sentiment. The US economy and stock market have outperformed virtually every global economy and market. Wages have grown nicely in the last few years. And yet sentiment remains subdued. What gives? First, the debate is highly partisan. Sentiment by Democrats tends to be positive while Republican sentiment tends to be more negative. Interestingly, Independents tend to skew closer to Republicans. But let’s try to remove the politics here and see if we can’t pull some objective facts out of this data because the one nice thing about the consumer sentiment surveys is that they provide a deep dive into the background data.I think we all know by now that the main sticking point here is the debate about inflation. Covid caused a huge supply chain problem which created shortages and then we printed trillions of dollars which kept demand bolstered. This combination resulted in a few years of very high inflation. And while inflation has moderated substantially consumers are still dealing with those high prices and tight credit conditions.The general narrative from Democrats is that the inflation was mostly supply side driven and to the extent it was stimulus and demand driven, it’s okay because wages have mostly kept pace with inflation. Republicans, on the other hand, tend to argue that the inflation was mostly demand driven due to the stimulus and has hurt consumers substantially.My general view is that the early stimulus was a no-brainer, regardless of the inflation it caused, because we just didn’t know how bad Covid would really be. I think there’s a strong argument that the 3rd stimulus and continued high deficit spending into 2023/24 was too much and made the Fed’s job much harder than it should have been. But I also find it tone deaf when I see this continual narrative that inflation wasn’t costly and that the stimulus was a free lunch (or not a causal factor in inflation). The stimulus was not a free lunch and the problem here is that inflation doesn’t impact everyone evenly and creates significant uncertainty. And the data bears this out:

First, the debate is highly partisan. Sentiment by Democrats tends to be positive while Republican sentiment tends to be more negative. Interestingly, Independents tend to skew closer to Republicans. But let’s try to remove the politics here and see if we can’t pull some objective facts out of this data because the one nice thing about the consumer sentiment surveys is that they provide a deep dive into the background data.I think we all know by now that the main sticking point here is the debate about inflation. Covid caused a huge supply chain problem which created shortages and then we printed trillions of dollars which kept demand bolstered. This combination resulted in a few years of very high inflation. And while inflation has moderated substantially consumers are still dealing with those high prices and tight credit conditions.The general narrative from Democrats is that the inflation was mostly supply side driven and to the extent it was stimulus and demand driven, it’s okay because wages have mostly kept pace with inflation. Republicans, on the other hand, tend to argue that the inflation was mostly demand driven due to the stimulus and has hurt consumers substantially.My general view is that the early stimulus was a no-brainer, regardless of the inflation it caused, because we just didn’t know how bad Covid would really be. I think there’s a strong argument that the 3rd stimulus and continued high deficit spending into 2023/24 was too much and made the Fed’s job much harder than it should have been. But I also find it tone deaf when I see this continual narrative that inflation wasn’t costly and that the stimulus was a free lunch (or not a causal factor in inflation). The stimulus was not a free lunch and the problem here is that inflation doesn’t impact everyone evenly and creates significant uncertainty. And the data bears this out:

This is very important because the big ticket items that consumers most need, home appliances, cars and houses, are all unaffordable compared to the past. So, even though inflation has moderated a lot it’s still very difficult to afford a home, car or large appliances because of credit conditions. So consumers are frustrated even though the economy is growing and inflation has moderated. The example I always like to consider is a middle class renter who was prudently saving to buy a home prior to Covid. This person has experienced a 25% increase in rents and watched home prices boom 50%. Meanwhile, mortgage rates went from 3% to 6% and now this person feels like they’re never going to be able to buy a house. This person is justifiably frustrated with the last 4 years.I write all of this because there’s this persistently tone deaf narrative from economists to “so what if inflation is up, so are wages so you should be thankful”. These economists are essentially saying that the low consumer sentiment is misguided, as if consumers aren’t capable of understanding the state of the economy. This narrative is, frankly, insulting.And yes, it’s true, the economy is better than expected and inflation has come down. But it’s also true that the increase in prices continues to be very frustrating for consumers because inflation doesn’t impact us on average. It impacts us at a personal level. And so if beef is your favorite thing to consume and inflation on average is up 21% according to the BLS, but beef prices are up 50% then you feel acutely harmed. And the inflation of the last few years has been asymmetric in many ways where prices went up the most across items that people deeply care about. So when people see tech prices falling and housing, cars and household durable prices surging they’re disproportionately harmed because these prices matter more than technology prices.In sum, the debate is complex. The truth probably lies in the middle, but I think we should be careful about dismissing people’s very real frustrations with the inflation of the last 4 years. The economy of the last 4 years has been very much an economy of the haves and have nots. Those who own homes and stocks feel great while the middle class renter feels justifiably frustrated. So let’s not insult those who have been harmed by the inflation and its very real costs.More By This Author:Three Things – Weekend Reading: Friday, Sept 27Three Things – Weekend Reading: Saturday, Sept. 21Three Things – The Fed Goes 50!!!!!

The example I always like to consider is a middle class renter who was prudently saving to buy a home prior to Covid. This person has experienced a 25% increase in rents and watched home prices boom 50%. Meanwhile, mortgage rates went from 3% to 6% and now this person feels like they’re never going to be able to buy a house. This person is justifiably frustrated with the last 4 years.I write all of this because there’s this persistently tone deaf narrative from economists to “so what if inflation is up, so are wages so you should be thankful”. These economists are essentially saying that the low consumer sentiment is misguided, as if consumers aren’t capable of understanding the state of the economy. This narrative is, frankly, insulting.And yes, it’s true, the economy is better than expected and inflation has come down. But it’s also true that the increase in prices continues to be very frustrating for consumers because inflation doesn’t impact us on average. It impacts us at a personal level. And so if beef is your favorite thing to consume and inflation on average is up 21% according to the BLS, but beef prices are up 50% then you feel acutely harmed. And the inflation of the last few years has been asymmetric in many ways where prices went up the most across items that people deeply care about. So when people see tech prices falling and housing, cars and household durable prices surging they’re disproportionately harmed because these prices matter more than technology prices.In sum, the debate is complex. The truth probably lies in the middle, but I think we should be careful about dismissing people’s very real frustrations with the inflation of the last 4 years. The economy of the last 4 years has been very much an economy of the haves and have nots. Those who own homes and stocks feel great while the middle class renter feels justifiably frustrated. So let’s not insult those who have been harmed by the inflation and its very real costs.More By This Author:Three Things – Weekend Reading: Friday, Sept 27Three Things – Weekend Reading: Saturday, Sept. 21Three Things – The Fed Goes 50!!!!!