To some it is the independent and impartial Swiss National Bank, to others it is the world’s biggest hedge fund with $584 billion in assets or about the same as the Swiss GDP, whose former chief suddenly resigned in 2012 following a family FX trading scandal.

Whatever it is, the SNB had an abysmal year: first and foremost it was its terrible bet on maintaining a EUR/CHF floor which imploded almost exactly a year ago, when the bank was forced to scrap its attempts to keep the Swiss Franc weak, in the process suffering tens of billions in losses.

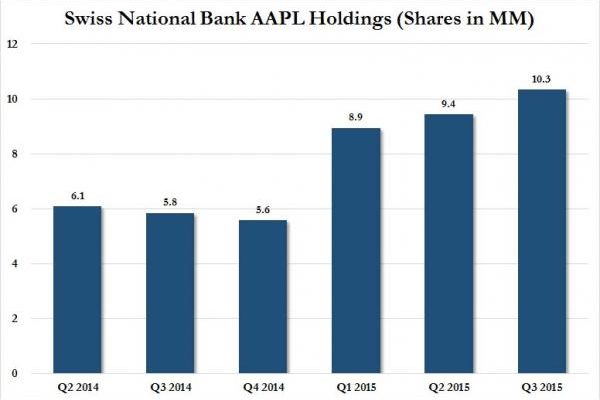

Then it was its unprecedented buying spree of US stocks, which in the first quarter of 2015 saw the SNB become one of the world’s biggest buyers, and holders, of AAPL. Since then the stock price entered a bear market, having tumbled to levels not seen since late 2014.

Â

Among its other holdings, the SNB also had substantial exposure not only to the crushed US shale and energy sector, but to the recent bete noire of the US pharma industry, the company everyone now loves to hate, after loving to love for years, leveraged roll-up expert, Valeant.

Â

And, as was to be expected in a year in which the smartest money around the world failed to generate any profit, the SNB was likewise slammed, and earlier today, it announced in a preliminary report (the full results will be out on March 4) that it had suffered a CHF23 billion ($23.05 billion) loss in the past year, or about 4% of its assets under management. In retrospect, considering some of the double-digit losses recorded by the marquee hedge fund names, a 4% loss looks downright respectable by funds who “hedge” only in name.

From the SNB:

Swiss National Bank expects annual loss of CHF 23 billion

Ordinary profit distribution, thanks to large distribution reserve

According to provisional calculations, the Swiss National Bank (SNB) will report a loss in the order of CHF 23 billion for the 2015 financial year. The loss on foreign currency positions amounted to CHF 20 billion. A valuation loss of CHF 4 billion was recorded on gold holdings. The net result from Swiss franc positions was CHF 1 billion. The allocation to the provisions for currency reserves is approximately CHF 1.4 billion. Taken together, the annual loss and allocation to provisions totalling some CHF 24.5 billion are less than the distribution reserve, which amounts to CHF 27.5 billion. Thus, despite the annual loss, the resulting balance sheet profit will allow a dividend payment of CHF 15 per share as well as the ordinary profit distribution of CHF 1 billion to the Confederation and the cantons. After these payments, the distribution reserve will amount to CHF 2 billion. A detailed report on the annual result with definitive figures will be released on 4 March 2016; the Annual Report will be published on 24 March 2016.