The Greece-Eurozone dispute has received a great deal of attention in the media in recent weeks. It seems however that contradicting statements and polarized views – Â many tainted by various political agendas – have created a great deal of confusion around the subject. As the parties resume negotiations this coming week, lets look at what each has to lose if a solution is not reached in time.

The damage to the euro area

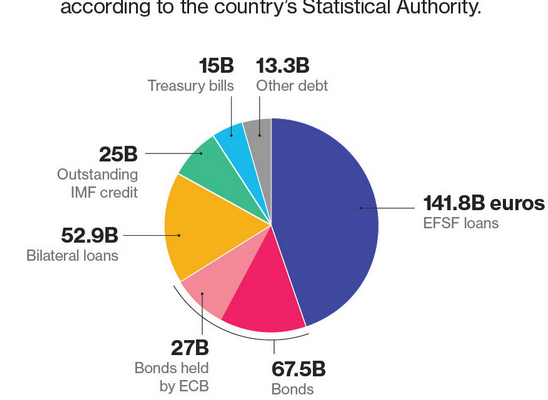

First of all it’s important to point out that the so-called “Grexit” is equivalent to a complete failure to pay on obligations by the Greek government, its banks, corporations, and households. While everyone is focused on the €315 billion Greece owes to the Eurozone, the IMF, and others, the damage to the euro area would actually be much greater.

Source: Bloomberg

What nobody wants to talk about is the fact that internally most Greek loans – including mortgages – are in euros (some are even in Swiss francs). Greek banks hold €227 billion of loans and €12.4 billion of Greek government debt (plus roughly another €25 – €50 billion of Greek-based private sector bonds). Under a Grexit scenario, most debt (including government debt) will be converted to the new drachma at a preset exchange rate.

As the drachma collapses – and there is little question that it will – Greek banks, who would now have drachma assets and euro liabilities, will quickly fail as well, leaving the Bank of Greece holding the bag. The Bank of Greece which is currently part of the Eurosystem will therefore default upon exit. But before it exits, the Bank of Greece will draw on Target2 from the rest of the Eurosystem as Greeks quickly move their deposits out (see how the mechanism works here with the Bank of Spain example). And there is no question Greeks will try to move a great deal of their deposits out before they are converted to drachmas. In December alone they pulled €4.6 billion euros out of Greek banks – and that’s before the Syriza victory.

The default by the Bank of Greece could cause even more damage to the system than the losses to EFSF and to other entities such as the IMF. Between the government bonds the Eurosystem holds and the Target2 losses, the ECB may need to be recapitalized – a political disaster. Market anxiety alone could push the euro area back into recession as credit conditions tighten again (potentially similar to the Lehman situation).

In the long run, if Grexit becomes a reality, the whole EMU could become unstable. History certainly isn’t on the euro area’s side.