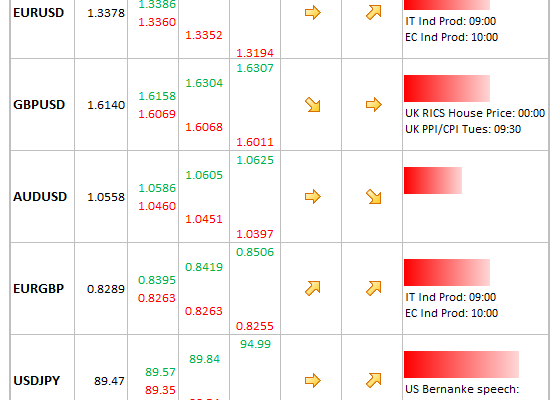

- EUR: Just Italian and Eurozone industrial production data today, both of which are not major event risks. More notable has been the positive sentiment pushing the single currency higher towards the end of last week. This could continue, especially if key upside levels are breached.

- USD: Fed Chairman Bernanke speaks this evening, which brings some risk of volatility as markets are now more sensitive to signs that the Fed may end its quantitative easing program this year. More indications that this could be the case would provide support for the dollar.

Idea of the Day

At least amongst politicians, there was a growing sense last week that things may have turned a corner. The ECB leader (Draghi) coined the phrase “positive contagionâ€, referring to (among other things) the fall in bond yields seen in the Eurozone periphery, a trend which started when he pledged to do “whatever it takes†to save the euro in the middle of last year.

In Japan, the weaker yen that has emerged has given a boost to a country that was all too used to deflation and minimal growth. Of course, politicians have a natural tendency to tell us that things will get better and there’s no doubt that some of the optimism will be mis-placed, but for now markets have been running with it. Most notable, EURJPY hit the 120 level overnight, continuing the dramatic move since the middle of November (when the Japanese election was announced). If the optimism remains on both sides then the bigger picture could easily see more EURJPY gains in the coming weeks.

Latest FX News

- EUR: Against the USD, the euro was at levels last seen at the end of Feb last year. Gains now being driven by positive developments on the euro side (lower yields, less chance rate cuts), rather than by default from weaker Japanese currency. EURJPY hit 120 overnight.

- JPY: There remains on-going talk of official purchases of overseas bonds, which has added to yen weakness overnight. The BoJ meeting is a week away and political pressure remains strong for them to deliver.

- GBP: Focus is turning towards the PM’s key speech on Europe next week, with growing expectations of a re-drafting of the UK’s relationship as the Eurozone integrates more. Sterling is dragging behind the bullishness being seen on the single currency and this could be a factor that weighs in the background.

- AUD: Feeling a little tired after last week’s failed attempt to push through the 1.06 area, with softer home loans data overnight also adding to the weaker stance.