Image Source:

Image Source:

Here are some things I think I am thinking about:

1) The Future is amazing (and lonely).The Apple Vision Pro is officially out. This is the first VR headset that appears viable. Early reviews sound amazing. A younger Cullen would have gone out and bought the first version of this device. I will never forget buying the first iPhone and sitting in restaurants. You could feel the eyes on you as you scrolled your phone. It was one of those devices that you just knew was totally game-changing. I won’t be buying the first version of this device mainly because I can’t imagine why I would need one. And that’s a big difference here. You aren’t going to get the FOMO you got from not having an AOL account or not having an iPhone. Then again, I also can’t have a fully informed opinion because I haven’t tried them so I’ll just which I thought was excellent.One thing that really stood out to me was the author’s focus on how lonely the Vision Pro is. And I don’t know if I am turning into an angry Luddite in my old age or if this is just the concerned father in me, but this quote actually scares me:“using the Vision Pro is such a lonely experience”It all took me back to a discussion I was having with my own father a few years back where I said that life today is so much better than it has ever been. He countered and said “life is easier in many ways, but also more complex to the point where it’s much more difficult”. I wasn’t quite sure what he meant by that at the time, but I understand it more now that I have kids and life feels overly complex in so many ways. A big part of that is that technology has made us far more productive and given us all access to things that literal kings and billionaires could have only dreamed of doing 100 years ago. So we put inordinate pressure on ourselves to optimize our time and relationships to the point where we’re stressed all the time. As hard as it was to be a farmer 100 years ago there are times where that simple sort of life sounds really nice compared to the one where you’re doom scrolling Instagram thinking about how cool someone else’s life appears.The saddest part of this is that it’s all about to get worse (it’s already bad and I won’t link you to the research because that would ruin your weekend). We’re not going to become more interconnected as a species at a personal level. In 200 years we’ll all have a robotic personal assistant. Heck, that assistant might also be your best friend and perhaps even your boy/girl friend. That’s where the world is going. I have no doubt. And yes, I think that’s a lonely future even though it will be incredible in many ways. It’s both exciting and scary and while I try to defer towards the optimistic view of things I also think it’s smart to encounter this new reality with eyes wide open because the social challenges are going to be immense.

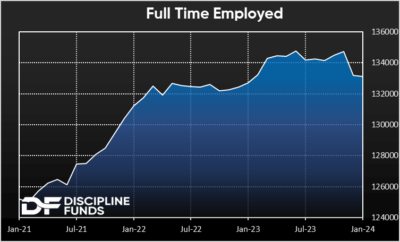

2) Another hot labor report.The idea of a March rate cut is officially dead. Friday’s hot labor report sealed the deal there. But you also have to be careful reading into single-month data because this is always noisy. For instance, the headline said we added 353K jobs. But when you peel back the onion hours worked were way down and full time employed actually declined. In other words, a lot of the labor market strength is coming from people who are just getting another job and working less at that “new” job.

Now, there are two ways to read this. You could read it as a sign of pessimism. Or, I think the more accurate view is that the labor market is robust, but maybe not as robust as the headline figure might have us think. In other words, people are getting a second job because they need more income to cover the rising cost of living. And the good news is that they’re able to find those jobs. But this is also confirmation that workers don’t have the sort of negotiating power they wish they did. And that’s weirdly good news for the future inflation story.In the end I don’t think the story has changed all that much. We’re still very much in the mean-reverting process from Covid and while I’d love to think that 350K+ job gains were sustainable I’d gladly take the under on the likely average job gains for 2024.

3) The Meta Dividend.One thing I’ve learned to better appreciate over time is the importance of income in a financial plan. When I work with people I actually quantify their employment as a bond. That is, your job is an asset that provides a fixed income. When you retire that fixed income disappears or declines. And that creates all sorts of uncertainty. And that’s part of why I am a big advocate of the idea of a bond tent – the idea that investors entering retirement should increase their bond allocation for a few years as they navigate the uncertainty of their income decline. In other words, when you fixed income declines you need another source of certainty to replace that lost income stream.It’s also one reason why people love dividend paying stocks. Dividends are (mostly reliable) income. Of course, the financial nerd in me hates dividends because they impose a taxable event on people that has could reduce long-term returns when compared to something like a buyback (all else equal). But there’s no substitute for the behavioral comfort of seeing the income come in.So I was shocked when I saw that Meta was going to start paying a dividend. My gut was “why would a tech company care about dividends when they should focus on growth and letting returns accrue thru principal appreciation”. But then I remembered that Meta is one of the biggest companies in the world and they probably should be focusing on trying to transition into more of a slow and steady grower as opposed to a high risk fast grower. And people who own those stable steady growers love income.Can they pull that transition off? This macro analyst doesn’t know enough about the micro to know the answer to that, but I certainly appreciate the behavioral comfort of income and I hope this income treats Meta shareholders well.I hope you have a great weekend.More By This Author:Media: Fed Decision AnalysisChart Of The Week: The Labor Market Continues To Soften How Worrisome Is The National Debt?

The Future Is Amazing (And Lonely)